Do You Use Legal Tax Optimization Measures? A Comprehensive Guide

Here’s the answer: Yes, using legal tax optimization measures is crucial for maximizing financial efficiency. Let’s explore why, how, and what benefits this brings to your automotive repair business.

Navigating the complexities of tax laws can be daunting, but CARDIAGTECH.NET is here to guide you through the process. Understanding and implementing these measures is not just about saving money, it’s about smart financial planning. Let’s delve into the world of tax optimization and discover how it can benefit your auto repair shop with strategic tax planning, financial efficiency, and compliance.

1. Understanding Legal Tax Optimization

What does it really mean to “use legal tax optimization measures,” and how does it differ from tax evasion?

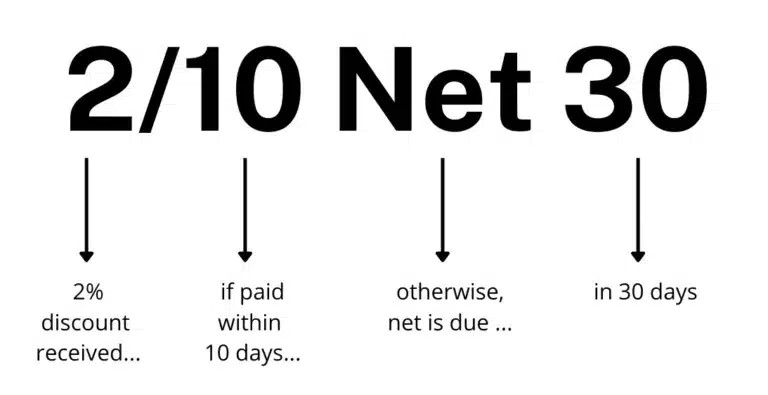

Legal tax optimization involves strategically leveraging tax laws and regulations to minimize your tax liability while remaining fully compliant with the law. This differs significantly from tax evasion, which is the illegal act of intentionally avoiding paying taxes by concealing income or providing false information. Tax optimization is about smart planning, not illegal avoidance.

According to the IRS, tax evasion can lead to severe penalties, including hefty fines and imprisonment. However, tax optimization, when done correctly, is a legitimate and ethical approach to managing your finances.

1.1 Key Differences Between Tax Optimization and Tax Evasion

| Feature | Tax Optimization | Tax Evasion |

|---|---|---|

| Legality | Legal and compliant | Illegal and fraudulent |

| Methods | Utilizing deductions, credits, and legal loopholes | Concealing income, false reporting |

| Goal | Minimize tax liability within legal boundaries | Avoid paying taxes illegally |

| Consequences | None, if done correctly | Fines, penalties, imprisonment |

| Transparency | Fully transparent and disclosed to tax authorities | Hidden and undisclosed |

For instance, claiming legitimate business expenses to reduce taxable income is tax optimization. In contrast, not reporting cash income to avoid paying taxes is tax evasion.

1.2 Why Tax Optimization is Essential for Auto Repair Shops

Tax optimization is particularly vital for auto repair shops due to the industry’s unique financial challenges. By strategically managing your taxes, you can free up capital for essential investments such as new equipment, employee training, and business expansion. According to a study by the Small Business Administration, effective tax planning can increase a small business’s profitability by up to 15%.

Benefits of Tax Optimization:

- Increased Profitability: Reducing tax liability directly boosts your bottom line.

- Improved Cash Flow: More available funds for day-to-day operations and investments.

- Enhanced Competitiveness: Better financial health allows for competitive pricing and service improvements.

- Long-Term Financial Security: Strategic tax planning contributes to sustainable growth and stability.

2. Common Legal Tax Optimization Measures for Auto Repair Businesses

What are some common and effective legal tax optimization measures that auto repair businesses can implement?

Several legal tax optimization measures are particularly beneficial for auto repair businesses. These include deducting business expenses, claiming depreciation on assets, utilizing tax credits, and strategically managing inventory. Each of these measures can significantly reduce your tax liability when implemented correctly.

2.1 Deducting Business Expenses

One of the most common and effective tax optimization measures is deducting legitimate business expenses. These expenses are directly related to the operation of your auto repair shop and can significantly reduce your taxable income.

Common Deductible Expenses:

- Rent or Mortgage Interest: The cost of your shop’s location is often a significant expense.

- Utilities: Electricity, water, gas, and internet bills are all deductible.

- Salaries and Wages: Compensation paid to employees, including benefits, is deductible.

- Supplies and Materials: Costs of parts, tools, and other materials used in repairs.

- Insurance: Business liability, auto, and workers’ compensation insurance premiums.

- Advertising and Marketing: Expenses for promoting your business.

- Professional Fees: Payments to accountants, lawyers, and consultants.

- Vehicle Expenses: Costs associated with business vehicles, including fuel, maintenance, and insurance.

The IRS provides detailed guidelines on what qualifies as a deductible business expense. For example, according to IRS Publication 535, a business expense must be both ordinary and necessary to be deductible. An ordinary expense is one that is common and accepted in your industry, while a necessary expense is one that is helpful and appropriate for your business.

2.2 Claiming Depreciation on Assets

Depreciation is another powerful tax optimization tool that allows you to deduct the cost of assets over their useful life. This is particularly beneficial for auto repair shops that invest in expensive equipment and machinery.

Depreciable Assets:

- Diagnostic Equipment: Scanners, code readers, and other diagnostic tools.

- Repair Tools: Lifts, welders, and other specialized repair equipment.

- Office Equipment: Computers, printers, and furniture.

- Vehicles: Cars and trucks used for business purposes.

- Building Improvements: Renovations or improvements to your shop.

According to Section 179 of the IRS tax code, you can deduct the full purchase price of qualifying equipment up to a certain limit in the year it was placed in service. For 2023, this limit is $1,160,000. This can provide a significant tax break in the short term.

The Modified Accelerated Cost Recovery System (MACRS) is another method used to depreciate assets over a longer period. MACRS allows you to deduct a certain percentage of the asset’s cost each year based on its class life. The IRS provides tables that specify the class life for different types of assets.

For example, if you purchase a diagnostic scanner for $10,000 with a 5-year class life, you can deduct a portion of its cost each year over those five years. This spreads the tax benefit over time, providing consistent savings.

2.3 Utilizing Tax Credits

Tax credits are direct reductions to your tax liability, making them even more valuable than deductions. Several tax credits may be available to auto repair businesses, depending on your specific circumstances.

Common Tax Credits:

- Work Opportunity Tax Credit (WOTC): Available for hiring individuals from certain targeted groups, such as veterans or individuals receiving public assistance.

- Research and Development (R&D) Tax Credit: If your shop engages in innovative activities, such as developing new repair techniques or improving existing processes, you may qualify for this credit.

- Energy-Efficient Commercial Buildings Deduction: For installing energy-efficient lighting, HVAC, or other systems in your shop.

- Small Business Health Care Tax Credit: If you provide health insurance to your employees, you may be eligible for this credit.

The WOTC, for example, can provide a credit of up to $9,600 per qualified employee. This can significantly reduce your tax liability while supporting employment opportunities in your community.

To claim these credits, you typically need to complete specific forms and provide documentation to support your eligibility. Consulting with a tax professional can help you identify and claim all the credits you are entitled to.

2.4 Managing Inventory Strategically

Proper inventory management can also lead to tax savings. The method you use to value your inventory can impact your taxable income. Common inventory valuation methods include First-In, First-Out (FIFO) and Last-In, First-Out (LIFO).

Inventory Valuation Methods:

- First-In, First-Out (FIFO): Assumes that the first items purchased are the first ones sold.

- Last-In, First-Out (LIFO): Assumes that the last items purchased are the first ones sold.

In a period of rising prices, using LIFO can result in a higher cost of goods sold and lower taxable income. However, LIFO is not permitted under International Financial Reporting Standards (IFRS) and may not be suitable for all businesses.

According to a study by Deloitte, choosing the right inventory valuation method can reduce a company’s tax liability by up to 10%. However, it’s essential to consult with a tax advisor to determine the most appropriate method for your business and to ensure compliance with tax regulations.

2.5 Strategic Timing of Income and Expenses

The timing of income and expenses can also impact your tax liability. Deferring income to a later tax year or accelerating expenses into the current tax year can help you manage your tax obligations more effectively.

Strategies for Timing Income and Expenses:

- Deferring Income: Delaying invoicing or payment collection until the following tax year.

- Accelerating Expenses: Prepaying for supplies or services before the end of the tax year.

- Making Capital Investments: Purchasing equipment or machinery before the end of the tax year to take advantage of depreciation deductions.

For example, if you anticipate a higher income in the following year, you may want to defer income to that year to avoid being taxed at a higher rate. Conversely, if you expect lower income in the current year, accelerating expenses can help reduce your tax liability.

3. How to Ensure Compliance While Optimizing Taxes

How can auto repair businesses ensure they remain compliant with tax laws while still taking advantage of legal tax optimization measures?

Ensuring compliance while optimizing taxes requires a thorough understanding of tax laws, meticulous record-keeping, and professional guidance. It’s crucial to stay informed about changes in tax regulations and to maintain accurate documentation of all income and expenses.

3.1 Meticulous Record-Keeping

Accurate and organized record-keeping is the foundation of tax compliance. Maintaining detailed records of all income, expenses, assets, and liabilities is essential for substantiating your tax returns and avoiding potential audits.

Essential Records to Keep:

- Sales Invoices: Records of all sales transactions.

- Purchase Invoices: Records of all purchases of supplies, materials, and equipment.

- Bank Statements: Records of all bank transactions, including deposits and withdrawals.

- Credit Card Statements: Records of all credit card transactions.

- Payroll Records: Records of employee wages, taxes, and benefits.

- Asset Records: Documentation of all assets, including purchase price, depreciation, and disposal.

- Mileage Logs: Records of business-related mileage for vehicle expense deductions.

According to the IRS, you should keep records for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. However, some records, such as those related to assets, should be kept for as long as you own the asset and potentially longer.

3.2 Staying Informed About Tax Laws

Tax laws are constantly evolving, and it’s essential to stay informed about changes that may affect your business. Regularly reviewing IRS publications, attending tax seminars, and consulting with tax professionals can help you stay up-to-date.

Resources for Staying Informed:

- IRS Website: Provides access to tax forms, publications, and updates.

- Tax Seminars and Webinars: Offered by professional organizations and tax experts.

- Industry Associations: Provide updates and guidance on tax-related issues specific to the auto repair industry.

- Tax Newsletters and Publications: Offer timely information on tax law changes and planning strategies.

For example, the Tax Cuts and Jobs Act of 2017 brought significant changes to tax laws, including lower corporate tax rates and new deductions for small businesses. Staying informed about these changes can help you adjust your tax planning strategies accordingly.

3.3 Seeking Professional Guidance

Working with a qualified tax professional is one of the best ways to ensure compliance and optimize your taxes. A tax advisor can provide personalized guidance based on your specific circumstances and help you navigate the complexities of tax laws.

Benefits of Hiring a Tax Professional:

- Expert Knowledge: Tax professionals have in-depth knowledge of tax laws and regulations.

- Personalized Guidance: They can provide tailored advice based on your specific business needs.

- Compliance Assurance: They can help you avoid costly mistakes and ensure compliance with tax laws.

- Time Savings: They can handle the time-consuming task of preparing and filing your taxes.

- Audit Support: They can represent you in the event of an audit and help you resolve any issues.

According to a survey by the National Small Business Association, small businesses that work with a tax professional are more likely to report higher profits and lower tax liabilities. A tax professional can also help you identify potential tax savings opportunities that you may not be aware of.

3.4 Regular Tax Planning Reviews

Conducting regular tax planning reviews is essential for identifying potential issues and opportunities. These reviews should be conducted at least annually, but more frequent reviews may be necessary if your business experiences significant changes.

Elements of a Tax Planning Review:

- Review of Financial Statements: Analyzing your income statement and balance sheet to identify potential tax savings opportunities.

- Assessment of Tax Credits and Deductions: Ensuring you are claiming all the credits and deductions you are entitled to.

- Evaluation of Inventory Valuation Methods: Determining if your current method is still the most appropriate for your business.

- Analysis of Timing Strategies: Assessing the impact of timing income and expenses on your tax liability.

- Review of Compliance Procedures: Ensuring you are following all applicable tax laws and regulations.

By conducting regular tax planning reviews, you can proactively identify and address potential issues before they become problems. This can help you avoid costly penalties and ensure you are optimizing your taxes effectively.

4. Potential Risks and How to Avoid Them

What are the potential risks associated with tax optimization, and how can auto repair businesses avoid them?

While tax optimization is a legitimate and beneficial practice, it’s essential to be aware of the potential risks and take steps to avoid them. These risks primarily involve misinterpreting tax laws or engaging in aggressive tax planning strategies that may not be defensible under scrutiny.

4.1 Misinterpreting Tax Laws

One of the most common risks is misinterpreting tax laws, which can lead to unintentional non-compliance. Tax laws are complex and constantly changing, making it challenging to stay up-to-date and understand all the nuances.

How to Avoid Misinterpreting Tax Laws:

- Seek Professional Guidance: Work with a qualified tax advisor who can provide expert interpretation of tax laws.

- Attend Tax Seminars and Webinars: Stay informed about changes in tax regulations and learn from experts in the field.

- Review IRS Publications: Consult official IRS publications for guidance on specific tax issues.

- Use Reliable Tax Software: Utilize tax software that is regularly updated to reflect changes in tax laws.

For example, claiming a deduction for an expense that does not meet the IRS’s requirements can result in penalties. By seeking professional guidance and staying informed, you can minimize the risk of misinterpreting tax laws.

4.2 Aggressive Tax Planning Strategies

Engaging in aggressive tax planning strategies that push the boundaries of what is legally permissible can also be risky. While it may be tempting to pursue strategies that promise significant tax savings, these strategies may not be defensible if challenged by the IRS.

How to Avoid Aggressive Tax Planning Strategies:

- Focus on Legitimate Tax Optimization: Prioritize strategies that are based on solid legal grounds and supported by documentation.

- Avoid Tax Shelters: Be wary of complex tax shelters that promise unrealistic tax savings.

- Seek Second Opinions: Consult with multiple tax professionals to get different perspectives on your tax planning strategies.

- Document Everything: Maintain thorough documentation to support your tax positions in case of an audit.

According to a report by the Government Accountability Office (GAO), aggressive tax planning strategies can increase the risk of audits and penalties. It’s essential to strike a balance between optimizing your taxes and staying within the bounds of the law.

4.3 Failure to Maintain Adequate Documentation

Failing to maintain adequate documentation is another common risk associated with tax optimization. Without proper documentation, you may not be able to substantiate your tax positions in the event of an audit, which can result in penalties and interest.

How to Avoid Failure to Maintain Adequate Documentation:

- Keep Detailed Records: Maintain accurate and organized records of all income, expenses, assets, and liabilities.

- Use Accounting Software: Utilize accounting software to track and manage your financial transactions.

- Scan and Store Documents: Scan and store important documents electronically to ensure they are easily accessible.

- Back Up Your Data: Regularly back up your data to protect against loss or damage.

The IRS requires taxpayers to keep records for as long as they may be relevant to tax administration. Failure to maintain adequate documentation can undermine your tax optimization efforts and expose you to unnecessary risks.

4.4 Ignoring Changes in Tax Laws

Ignoring changes in tax laws can also lead to non-compliance and potential penalties. Tax laws are constantly evolving, and it’s essential to stay informed about changes that may affect your business.

How to Avoid Ignoring Changes in Tax Laws:

- Subscribe to Tax Newsletters: Stay informed about tax law changes through newsletters and publications.

- Attend Tax Seminars and Webinars: Participate in educational events to learn about new tax laws and regulations.

- Consult with a Tax Professional: Regularly consult with a tax advisor to stay up-to-date on tax law changes and their implications for your business.

- Review IRS Updates: Check the IRS website regularly for updates on tax laws and regulations.

For example, the Tax Cuts and Jobs Act of 2017 brought significant changes to tax laws, including lower corporate tax rates and new deductions for small businesses. Ignoring these changes could result in missed opportunities for tax savings or non-compliance with the law.

5. Tools and Resources for Effective Tax Optimization

What tools and resources are available to help auto repair businesses effectively optimize their taxes?

Several tools and resources can assist auto repair businesses in effectively optimizing their taxes. These include accounting software, tax planning software, IRS publications, and professional tax advisors.

5.1 Accounting Software

Accounting software can help you track your income and expenses, manage your financial records, and prepare your tax returns. Popular accounting software options for small businesses include QuickBooks, Xero, and FreshBooks.

Benefits of Using Accounting Software:

- Automated Tracking: Automatically tracks income and expenses, saving time and effort.

- Financial Reporting: Generates financial reports that provide insights into your business performance.

- Tax Preparation: Simplifies the process of preparing your tax returns.

- Compliance: Helps you stay compliant with accounting standards and tax regulations.

According to a survey by Intuit, small businesses that use accounting software are more likely to report higher profits and lower tax liabilities. Accounting software can also help you identify potential tax savings opportunities that you may not be aware of.

5.2 Tax Planning Software

Tax planning software can help you model different tax scenarios and optimize your tax strategies. These tools can help you identify potential tax savings opportunities and make informed decisions about your tax planning.

Popular Tax Planning Software Options:

- TurboTax: Offers a range of tax planning tools for individuals and small businesses.

- H&R Block: Provides tax planning software and services for individuals and businesses.

- TaxAct: Offers affordable tax planning software with a range of features.

- CCH ProSystem fx Tax: A comprehensive tax planning solution for tax professionals.

Tax planning software can help you estimate your tax liability, identify potential deductions and credits, and optimize your tax strategies. These tools can also help you stay informed about changes in tax laws and regulations.

5.3 IRS Publications

The IRS provides a wealth of information on tax laws and regulations through its publications. These publications cover a wide range of topics, including business expenses, depreciation, tax credits, and more.

Key IRS Publications for Small Businesses:

- Publication 334: Tax Guide for Small Business

- Publication 463: Travel, Gift, and Car Expenses

- Publication 505: Tax Withholding and Estimated Tax

- Publication 535: Business Expenses

- Publication 946: How to Depreciate Property

These publications provide detailed guidance on tax laws and regulations and can help you understand your tax obligations and opportunities.

5.4 Professional Tax Advisors

Working with a qualified tax advisor is one of the best ways to ensure compliance and optimize your taxes. A tax advisor can provide personalized guidance based on your specific circumstances and help you navigate the complexities of tax laws.

Benefits of Hiring a Tax Professional:

- Expert Knowledge: Tax professionals have in-depth knowledge of tax laws and regulations.

- Personalized Guidance: They can provide tailored advice based on your specific business needs.

- Compliance Assurance: They can help you avoid costly mistakes and ensure compliance with tax laws.

- Time Savings: They can handle the time-consuming task of preparing and filing your taxes.

- Audit Support: They can represent you in the event of an audit and help you resolve any issues.

According to a survey by the National Small Business Association, small businesses that work with a tax professional are more likely to report higher profits and lower tax liabilities. A tax professional can also help you identify potential tax savings opportunities that you may not be aware of.

6. Case Studies: Successful Tax Optimization in Auto Repair Shops

Can you provide some real-world examples or case studies of how tax optimization has benefited auto repair shops?

To illustrate the practical benefits of tax optimization, let’s examine a few hypothetical case studies of auto repair shops that have successfully implemented various tax optimization measures.

6.1 Case Study 1: Deducting Business Expenses at “Reliable Auto Repair”

Background: Reliable Auto Repair is a small auto repair shop in Los Angeles, California. The owner, John, was struggling to manage his finances and was looking for ways to reduce his tax liability.

Solution: John hired a tax advisor who helped him identify and deduct all eligible business expenses. These included rent, utilities, salaries, supplies, insurance, and advertising.

Results: By deducting all eligible business expenses, John was able to reduce his taxable income by $30,000, resulting in a tax savings of $7,500. This allowed him to invest in new diagnostic equipment and improve his shop’s services.

6.2 Case Study 2: Claiming Depreciation on Assets at “Precision Auto Services”

Background: Precision Auto Services is a medium-sized auto repair shop in Houston, Texas. The owner, Maria, had recently invested in new lifts and other specialized repair equipment.

Solution: Maria worked with her tax advisor to claim depreciation on these assets using the MACRS method. This allowed her to deduct a portion of the cost of the assets each year over their useful life.

Results: By claiming depreciation on her assets, Maria was able to reduce her taxable income by $20,000, resulting in a tax savings of $5,000. This allowed her to hire an additional technician and expand her shop’s services.

6.3 Case Study 3: Utilizing Tax Credits at “Expert Auto Care”

Background: Expert Auto Care is a large auto repair shop in Miami, Florida. The owner, David, was looking for ways to reduce his tax liability while also supporting his community.

Solution: David hired veterans and individuals receiving public assistance, making him eligible for the Work Opportunity Tax Credit (WOTC).

Results: By utilizing the WOTC, David was able to claim a credit of $9,600 per qualified employee, resulting in a tax savings of $19,200. This allowed him to invest in employee training and improve his shop’s services.

6.4 Case Study 4: Strategic Timing of Income and Expenses at “Quality Auto Repairs”

Background: Quality Auto Repairs is a family-owned auto repair shop in Chicago, Illinois. The owner, Sarah, was anticipating a higher income in the following year and wanted to manage her tax obligations more effectively.

Solution: Sarah worked with her tax advisor to defer income to the following tax year and accelerate expenses into the current tax year. This included delaying invoicing and prepaying for supplies.

Results: By strategically timing her income and expenses, Sarah was able to reduce her taxable income in the current year by $15,000, resulting in a tax savings of $3,750. This allowed her to invest in new marketing initiatives and attract more customers.

7. Future Trends in Tax Optimization for the Auto Repair Industry

What are some emerging trends in tax optimization that auto repair businesses should be aware of?

As tax laws and business practices evolve, several emerging trends in tax optimization are particularly relevant to the auto repair industry. These include increased use of technology, focus on green initiatives, and changes in international tax rules.

7.1 Increased Use of Technology

The increasing use of technology in the auto repair industry is creating new opportunities for tax optimization. For example, using cloud-based accounting software can streamline your financial record-keeping and simplify tax preparation.

Emerging Technologies for Tax Optimization:

- Cloud-Based Accounting Software: Provides real-time access to financial data and simplifies tax preparation.

- AI-Powered Tax Planning Tools: Use artificial intelligence to analyze your financial data and identify potential tax savings opportunities.

- Blockchain Technology: Can be used to track and verify financial transactions, improving transparency and compliance.

According to a report by McKinsey, the adoption of digital technologies can reduce a company’s tax compliance costs by up to 20%. Embracing technology can not only improve your tax optimization efforts but also enhance your overall business efficiency.

7.2 Focus on Green Initiatives

With growing concerns about climate change, governments are increasingly offering tax incentives for businesses that adopt green initiatives. Auto repair shops that invest in energy-efficient equipment or offer environmentally friendly services may be eligible for tax credits and deductions.

Green Initiatives for Tax Optimization:

- Installing Energy-Efficient Lighting: Can qualify for the Energy-Efficient Commercial Buildings Deduction.

- Using Renewable Energy Sources: Can qualify for tax credits and rebates.

- Offering Electric Vehicle (EV) Services: Can attract customers and potentially qualify for tax incentives.

- Recycling and Waste Reduction: Can reduce operating costs and potentially qualify for tax benefits.

According to a study by the Environmental Protection Agency (EPA), investing in energy-efficient equipment can reduce a company’s energy costs by up to 30%. By adopting green initiatives, you can not only reduce your environmental impact but also improve your financial performance.

7.3 Changes in International Tax Rules

Changes in international tax rules, such as the OECD’s Base Erosion and Profit Shifting (BEPS) project, can impact auto repair businesses that operate internationally or have foreign suppliers. It’s essential to stay informed about these changes and adjust your tax planning strategies accordingly.

Key Changes in International Tax Rules:

- BEPS Project: Aims to prevent multinational corporations from avoiding taxes by shifting profits to low-tax jurisdictions.

- Digital Tax: Some countries are implementing taxes on digital services provided by foreign companies.

- Trade Agreements: New trade agreements can impact tariffs and other taxes on imported goods.

According to a report by PwC, changes in international tax rules are increasing the complexity of tax planning for multinational corporations. Staying informed about these changes and seeking expert guidance can help you manage your international tax obligations effectively.

8. Getting Started with Tax Optimization

What are the first steps an auto repair business should take to start optimizing its taxes effectively?

Starting the journey towards effective tax optimization involves several key steps. These include assessing your current financial situation, setting clear goals, gathering necessary documentation, and seeking professional advice.

8.1 Assess Your Current Financial Situation

The first step is to thoroughly assess your current financial situation. This involves reviewing your income statement, balance sheet, and cash flow statement to understand your business’s financial performance.

Key Areas to Assess:

- Income: Total revenue generated by your business.

- Expenses: All costs incurred in operating your business.

- Assets: Property and equipment owned by your business.

- Liabilities: Debts and obligations owed by your business.

- Cash Flow: Movement of cash into and out of your business.

By understanding your current financial situation, you can identify potential areas for tax optimization and set realistic goals.

8.2 Set Clear Goals

The next step is to set clear goals for your tax optimization efforts. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Examples of SMART Goals:

- Specific: Reduce your tax liability by 15% in the next tax year.

- Measurable: Track your income and expenses accurately using accounting software.

- Achievable: Implement tax optimization strategies based on your business’s specific circumstances.

- Relevant: Focus on strategies that align with your business goals and values.

- Time-Bound: Achieve your tax optimization goals within the next 12 months.

Setting clear goals will provide direction and motivation for your tax optimization efforts.

8.3 Gather Necessary Documentation

Gathering all necessary documentation is essential for substantiating your tax positions and avoiding potential audits. This includes income statements, expense reports, asset records, and any other documents relevant to your tax planning.

Essential Documents to Gather:

- Income Statements: Reports of your business’s revenue and expenses.

- Balance Sheets: Reports of your business’s assets, liabilities, and equity.

- Cash Flow Statements: Reports of the movement of cash into and out of your business.

- Expense Reports: Detailed records of all business expenses.

- Asset Records: Documentation of all assets, including purchase price, depreciation, and disposal.

- Tax Returns: Copies of your previous tax returns.

Having all necessary documentation readily available will streamline the tax preparation process and reduce the risk of errors.

8.4 Seek Professional Advice

Seeking professional advice from a qualified tax advisor is one of the best ways to ensure compliance and optimize your taxes. A tax advisor can provide personalized guidance based on your specific circumstances and help you navigate the complexities of tax laws.

Benefits of Seeking Professional Advice:

- Expert Knowledge: Tax advisors have in-depth knowledge of tax laws and regulations.

- Personalized Guidance: They can provide tailored advice based on your specific business needs.

- Compliance Assurance: They can help you avoid costly mistakes and ensure compliance with tax laws.

- Time Savings: They can handle the time-consuming task of preparing and filing your taxes.

- Audit Support: They can represent you in the event of an audit and help you resolve any issues.

By seeking professional advice, you can ensure that you are taking full advantage of all available tax savings opportunities while remaining compliant with the law.

9. Conclusion: Embracing Legal Tax Optimization for Long-Term Success

In conclusion, using legal tax optimization measures is not just about saving money; it’s about building a sustainable and financially healthy auto repair business. By understanding and implementing these strategies, you can free up capital for essential investments, improve your cash flow, and enhance your competitiveness.

Remember, the key to successful tax optimization is to remain compliant with tax laws, maintain meticulous records, and seek professional guidance when needed. Embracing these practices will not only help you minimize your tax liability but also contribute to the long-term success of your auto repair shop.

At CARDIAGTECH.NET, we understand the challenges you face in the auto repair industry. That’s why we offer a range of high-quality diagnostic tools and equipment to help you improve your efficiency and profitability. Contact us today at +1 (641) 206-8880 or visit our website at CARDIAGTECH.NET to learn more about how we can support your business. Our address is 276 Reock St, City of Orange, NJ 07050, United States. Let us help you take your auto repair shop to the next level.

FAQ: Legal Tax Optimization Measures

Here are some frequently asked questions about legal tax optimization measures for auto repair businesses:

-

What is the difference between tax optimization and tax evasion?

Tax optimization involves legally minimizing your tax liability by utilizing deductions, credits, and other legal strategies. Tax evasion is the illegal act of intentionally avoiding paying taxes by concealing income or providing false information. -

What are some common deductible business expenses for auto repair shops?

Common deductible business expenses include rent or mortgage interest, utilities, salaries and wages, supplies and materials, insurance, advertising and marketing, professional fees, and vehicle expenses. -

How can I claim depreciation on my assets?

You can claim depreciation on assets using the Modified Accelerated Cost Recovery System (MACRS), which allows you to deduct a certain percentage of the asset’s cost each year based on its class life. You can also use Section 179 of the IRS tax code to deduct the full purchase price of qualifying equipment up to a certain limit in the year it was placed in service. -

What are some tax credits available for auto repair businesses?

Common tax credits include the Work Opportunity Tax Credit (WOTC), the Research and Development (R&D) Tax Credit, the Energy-Efficient Commercial Buildings Deduction, and the Small Business Health Care Tax Credit. -

How does inventory management affect my tax liability?

The method you use to value your inventory, such as First-In, First-Out (FIFO) or Last-In, First-Out (LIFO), can impact your taxable income. In a period of rising prices, using LIFO can result in a higher cost of goods sold and lower taxable income. -

What is strategic timing of income and expenses?

Strategic timing of income and expenses involves deferring income to a later tax year or accelerating expenses into the current tax year to manage your tax obligations more effectively. -

How can I ensure compliance while optimizing my taxes?

To ensure compliance, maintain meticulous records, stay informed about tax laws, seek professional guidance, and conduct regular tax planning reviews. -

What are some potential risks associated with tax optimization?

Potential risks include misinterpreting tax laws, engaging in aggressive tax planning strategies, failing to maintain adequate documentation, and ignoring changes in tax laws. -

What tools and resources are available to help me optimize my taxes?

Useful tools and resources include accounting software, tax planning software, IRS publications, and professional tax advisors. -

What are the first steps I should take to start optimizing my taxes?

The first steps include assessing your current financial situation, setting clear goals, gathering necessary documentation, and seeking professional advice.