Can My Insurance Company Refuse to Fix Car?

Navigating the aftermath of a car accident can be stressful, and understanding your insurance coverage is crucial. Can my insurance company refuse to fix my car? This article from CARDIAGTECH.NET explores the circumstances where your insurer might deny repairs and what options you have. Understanding the process is vital for a smooth claims experience, especially if you want to make informed decisions about auto body repairs and potential diminished value claims.

1. Understanding Your Insurance Policy

The first step in determining whether your insurance company can refuse to fix your car is to thoroughly review your insurance policy. Policies vary widely, and the specifics of your coverage will dictate your rights and responsibilities.

-

Coverage Types: Familiarize yourself with the types of coverage you have, such as collision, comprehensive, and liability. Collision coverage typically pays for damage to your vehicle resulting from an accident, regardless of fault. Comprehensive coverage covers damages from non-collision events like theft, vandalism, or natural disasters. Liability coverage pays for damages you cause to others.

-

Exclusions: Pay close attention to any exclusions listed in your policy. Exclusions are specific situations or types of damage that your insurance company will not cover. Common exclusions include damage from racing, intentional acts, or using your vehicle for commercial purposes if it’s insured for personal use.

-

Policy Limits: Understand your policy limits, which is the maximum amount your insurance company will pay for a covered claim. If the cost of repairs exceeds your policy limits, you may be responsible for paying the difference out of pocket.

-

Deductibles: Know your deductible amount, which is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and the repair costs are $2,000, you will pay $500, and your insurance company will pay the remaining $1,500.

-

Terms and Conditions: Read the terms and conditions carefully. These outline the rules and procedures you must follow when filing a claim. Failing to comply with these terms could result in a denial of your claim.

Understanding these key aspects of your insurance policy will help you anticipate potential issues and ensure that you are prepared to navigate the claims process effectively. For those looking to maintain their vehicles in top condition, CARDIAGTECH.NET offers a range of diagnostic tools and equipment to assist with pre- and post-accident inspections, ensuring you get the most accurate assessment of your vehicle’s condition.

2. Reasons Why an Insurance Company Might Refuse to Fix Your Car

Several reasons could lead an insurance company to refuse to fix your car. Understanding these potential issues can help you prepare and respond effectively.

-

Policy Exclusions: As mentioned earlier, policy exclusions can be a primary reason for denial. If the damage to your vehicle falls under a specific exclusion, the insurance company is not obligated to pay for the repairs.

-

Lapse in Coverage: If your insurance policy was not in effect at the time of the accident, the insurance company will deny the claim. This could happen if you failed to pay your premium or if your policy was canceled for any other reason.

-

Misrepresentation: Providing false information when applying for insurance or filing a claim can lead to denial. This includes lying about your driving history, the condition of your vehicle, or the circumstances of the accident.

-

Insufficient Coverage: If the cost of repairs exceeds your policy limits, the insurance company will only pay up to the maximum amount specified in your policy. You will be responsible for covering the remaining balance.

-

Disputed Liability: If there is a dispute over who was at fault for the accident, the insurance company may delay or deny the claim until liability is determined. This often happens in accidents with unclear circumstances or conflicting accounts.

-

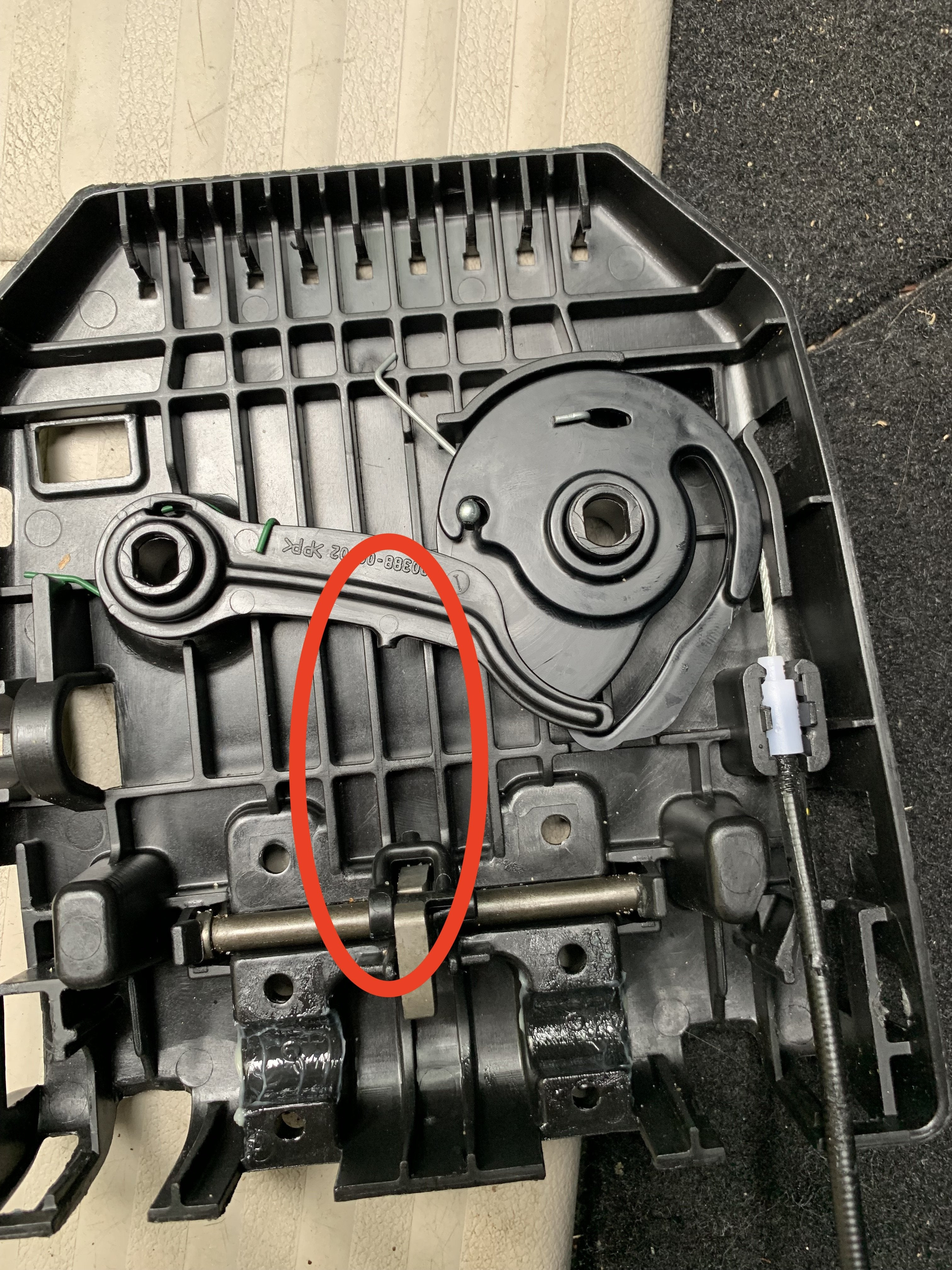

Pre-Existing Damage: Insurance companies are not responsible for repairing pre-existing damage to your vehicle. If the damage was present before the accident, the insurance company may refuse to cover those specific repairs.

-

Total Loss: If the cost to repair your vehicle exceeds its actual cash value (ACV), the insurance company may declare it a total loss. In this case, they will offer you a settlement for the ACV of the vehicle instead of paying for repairs.

-

Fraudulent Claims: Attempting to file a fraudulent claim, such as staging an accident or exaggerating the extent of the damage, can result in denial and potential legal consequences.

-

Failure to Cooperate: Insurance policies require you to cooperate with the investigation of your claim. Failure to provide requested information, attend examinations under oath, or allow access to your vehicle for inspection can lead to denial.

Knowing these potential pitfalls can help you avoid mistakes and ensure a smoother claims process. CARDIAGTECH.NET provides tools and resources that can assist in accurately assessing vehicle damage, helping you build a strong case when dealing with insurance companies.

3. Steps to Take If Your Claim Is Denied

If your insurance company denies your claim, it is important to take immediate and strategic steps to protect your rights.

-

Request a Written Explanation: The first step is to request a written explanation from the insurance company outlining the reasons for the denial. This document will provide valuable information and help you understand the specific issues you need to address.

-

Review Your Policy: Carefully review your insurance policy to ensure that the denial is consistent with the terms and conditions. Look for any clauses or provisions that support your claim and highlight these in your response.

-

Gather Evidence: Collect all relevant evidence that supports your claim. This may include police reports, witness statements, photos of the damage, repair estimates, and any other documentation that strengthens your case.

-

Obtain a Second Opinion: Get a second opinion from an independent mechanic or appraiser regarding the extent of the damage and the cost of repairs. This can provide an unbiased assessment and help you challenge the insurance company’s evaluation.

-

File an Appeal: Most insurance companies have an internal appeals process. Follow the instructions provided by the insurance company to file an appeal, presenting all the evidence and arguments in support of your claim.

-

Contact the Department of Insurance: If you are not satisfied with the outcome of the appeal, you can file a complaint with your state’s Department of Insurance. This regulatory agency can investigate the insurance company’s handling of your claim and help resolve the dispute.

-

Consider Mediation or Arbitration: Mediation involves working with a neutral third party to reach a settlement agreement. Arbitration involves presenting your case to an arbitrator who will make a binding decision. Both options can be less expensive and time-consuming than going to court.

-

Consult with an Attorney: If all else fails, consider consulting with an attorney who specializes in insurance claims. An attorney can review your case, advise you on your legal options, and represent you in negotiations or litigation.

Taking these steps can help you challenge the denial and potentially recover the compensation you deserve. CARDIAGTECH.NET offers tools that can aid in documenting and assessing vehicle damage, providing critical evidence to support your claim.

4. Understanding the “Actual Cash Value” (ACV)

When an insurance company declares your vehicle a total loss, they will offer you a settlement based on its Actual Cash Value (ACV). Understanding how ACV is determined is crucial to ensuring you receive a fair settlement.

-

Definition: ACV is the fair market value of your vehicle immediately before the accident. It takes into account depreciation, wear and tear, and other factors that affect the vehicle’s value.

-

Determination: Insurance companies typically use a variety of sources to determine ACV, including:

- Market Data: They may consult pricing guides like Kelley Blue Book, NADA, and Edmunds to determine the average selling price of similar vehicles in your area.

- Comparable Sales: They may research recent sales of comparable vehicles (same make, model, year, mileage, and condition) in your local market.

- Vehicle Inspection: They will inspect your vehicle to assess its condition and identify any pre-existing damage or wear and tear that could affect its value.

-

Factors Affecting ACV: Several factors can influence the ACV of your vehicle, including:

- Age and Mileage: Older vehicles and those with higher mileage typically have lower ACVs.

- Condition: Vehicles in poor condition with significant wear and tear will have lower ACVs.

- Options and Features: Vehicles with desirable options and features may have higher ACVs.

- Market Demand: The demand for your specific make and model in your local market can affect its ACV.

-

Negotiating the ACV: If you disagree with the insurance company’s ACV assessment, you have the right to negotiate. To support your position, you can:

- Gather Evidence: Collect evidence of comparable sales in your area that support a higher valuation.

- Highlight Improvements: Point out any recent repairs, upgrades, or maintenance that could increase the vehicle’s value.

- Obtain an Independent Appraisal: Hire an independent appraiser to assess the vehicle’s value and provide a professional opinion.

-

Total Loss Settlement: If you accept the insurance company’s ACV offer, they will typically deduct your deductible and any outstanding loan balance from the settlement amount. You will then sign over the vehicle’s title to the insurance company.

Understanding ACV and how it is determined can help you negotiate a fair settlement and ensure that you are adequately compensated for your total loss. CARDIAGTECH.NET provides tools that can assist in assessing vehicle condition and estimating repair costs, giving you a stronger position when negotiating with insurance companies.

5. Diminished Value Claims

Even if your car is repaired after an accident, it may still suffer a loss in value due to its accident history. This loss is known as diminished value, and you may be entitled to compensation for it.

-

Definition: Diminished value is the reduction in a vehicle’s market value resulting from damage and repair. Even if the repairs are done perfectly, the vehicle may be worth less than a comparable vehicle with no accident history.

-

Types of Diminished Value: There are three main types of diminished value:

- Inherent Diminished Value: This is the automatic loss in value that occurs simply because the vehicle has been in an accident.

- Repair-Related Diminished Value: This is the loss in value resulting from substandard repairs or the use of non-OEM parts.

- Claim-Related Diminished Value: This is the loss in value resulting from the stigma associated with a vehicle that has been involved in a significant accident.

-

Eligibility: To be eligible for a diminished value claim, you typically need to meet the following criteria:

- The accident was not your fault.

- Your vehicle has been repaired.

- Your vehicle has suffered a loss in value due to the accident history.

-

Calculating Diminished Value: There are several methods for calculating diminished value, including:

- The 17c Formula: This is a common formula used by insurance companies that takes 10% of the vehicle’s pre-accident value and then adjusts it based on the severity of the damage.

- The Stated Value Method: This method involves obtaining an appraisal from a qualified appraiser who will assess the vehicle’s pre- and post-accident value and determine the difference.

- The Cost of Repair Method: This method involves using the cost of repairs as a starting point and then adjusting it based on various factors.

-

Filing a Diminished Value Claim: To file a diminished value claim, you will need to:

- Gather Evidence: Collect all relevant documents, including the police report, repair estimates, photos of the damage, and proof of the vehicle’s pre-accident value.

- Obtain an Appraisal: Hire a qualified appraiser to assess the vehicle’s diminished value and provide a written report.

- Submit Your Claim: Submit your claim to the responsible insurance company, along with all supporting documentation.

-

Negotiating the Claim: Be prepared to negotiate with the insurance company, as they may try to minimize the amount of your settlement. You may need to provide additional evidence or obtain a second appraisal to support your position.

Pursuing a diminished value claim can help you recover the full value of your vehicle and compensate you for the loss resulting from the accident. CARDIAGTECH.NET offers tools and resources that can assist in assessing vehicle damage and documenting repair quality, providing valuable evidence to support your claim.

6. Choosing Your Own Repair Shop

In many jurisdictions, you have the right to choose your own repair shop, regardless of whether the insurance company recommends a particular shop.

-

Your Right to Choose: Many states have laws that protect your right to choose your own repair shop. Insurance companies cannot force you to use a specific shop or steer you towards shops that they prefer.

-

Benefits of Choosing Your Own Shop: There are several benefits to choosing your own repair shop:

- Trust and Familiarity: You can choose a shop that you trust and have a prior relationship with.

- Quality of Repairs: You can choose a shop that has a reputation for high-quality repairs and uses skilled technicians.

- Customer Service: You can choose a shop that provides excellent customer service and is responsive to your needs.

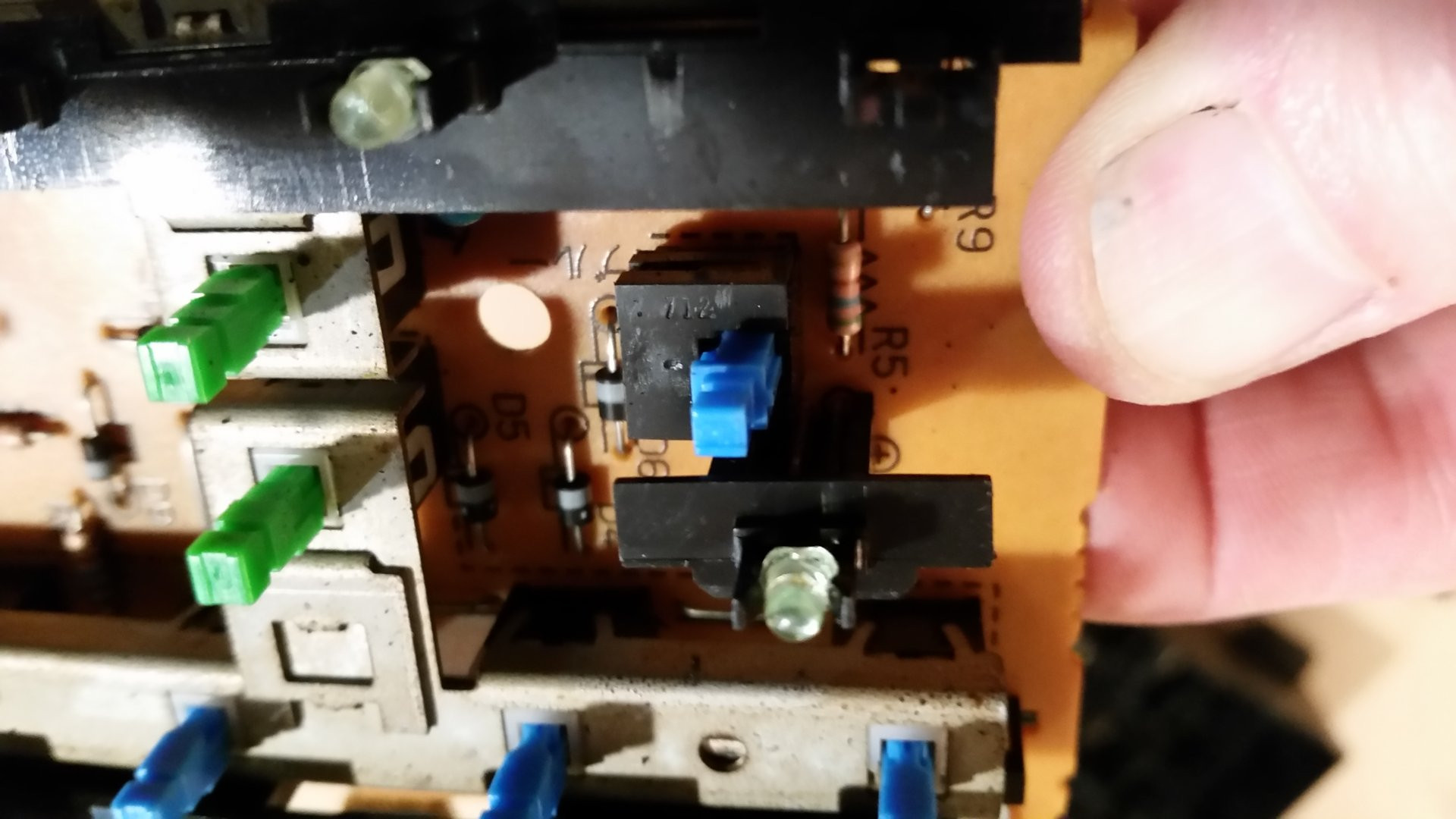

- OEM Parts: You can choose a shop that is willing to use OEM (Original Equipment Manufacturer) parts, which are generally considered to be of higher quality than aftermarket parts.

-

Insurance Company Recommendations: While insurance companies may recommend certain repair shops, you are not obligated to use them. These shops may be part of the insurance company’s direct repair program (DRP), which means they have agreed to certain terms and conditions in exchange for referrals.

-

Potential Conflicts of Interest: Be aware that repair shops in a DRP may have a conflict of interest, as they may be incentivized to keep costs down in order to maintain their relationship with the insurance company. This could potentially compromise the quality of the repairs.

-

Negotiating with the Insurance Company: If you choose a repair shop that is not in the insurance company’s DRP, the insurance company may try to negotiate the repair costs. You have the right to negotiate as well, and you can provide evidence to support the reasonableness of the repair estimate.

-

Getting a Second Opinion: If you are unsure about which repair shop to choose, get a second opinion from an independent mechanic or appraiser. They can assess the damage and provide an unbiased recommendation.

Exercising your right to choose your own repair shop can help ensure that your vehicle is repaired to your satisfaction and that you receive fair treatment throughout the claims process. CARDIAGTECH.NET offers tools that can assist in assessing repair quality and identifying potential issues, giving you greater confidence in the repair process.

7. Understanding OEM vs. Aftermarket Parts

A common point of contention in auto repairs is the use of OEM (Original Equipment Manufacturer) versus aftermarket parts. Understanding the differences and your rights can help you navigate this issue.

-

OEM Parts: OEM parts are made by the original manufacturer of your vehicle. They are designed to meet the exact specifications and standards of the original parts.

-

Aftermarket Parts: Aftermarket parts are made by third-party manufacturers. They are designed to be compatible with your vehicle but may not be identical to OEM parts in terms of quality, fit, and performance.

-

Quality and Performance: OEM parts are generally considered to be of higher quality than aftermarket parts. They are designed to provide optimal performance and durability and are backed by the manufacturer’s warranty. Aftermarket parts may vary in quality, and some may not meet the same standards as OEM parts.

-

Cost: Aftermarket parts are typically less expensive than OEM parts. This is because they are often made with less expensive materials and manufacturing processes.

-

Insurance Company Policies: Insurance companies may have policies regarding the use of OEM versus aftermarket parts. Some policies may allow the use of aftermarket parts if they are of comparable quality to OEM parts, while others may require the use of OEM parts.

-

Your Right to Choose: In many jurisdictions, you have the right to request the use of OEM parts in your vehicle’s repairs. However, you may be required to pay the difference in cost if your insurance policy only covers the cost of aftermarket parts.

-

Safety Considerations: In some cases, the use of aftermarket parts may raise safety concerns. For example, if an aftermarket airbag does not deploy properly in an accident, it could result in serious injury or death.

-

Warranty Implications: The use of aftermarket parts may void your vehicle’s warranty, particularly if the parts cause damage to other components.

-

Negotiating with the Insurance Company: If you want to use OEM parts but your insurance company only covers the cost of aftermarket parts, you may need to negotiate. You can provide evidence to support the importance of using OEM parts, such as safety concerns or warranty implications.

Understanding the differences between OEM and aftermarket parts and your rights can help you make informed decisions about your vehicle’s repairs. CARDIAGTECH.NET offers tools that can assist in assessing the quality of auto parts and identifying potential issues, giving you greater confidence in the repair process.

8. Deductibles: What You Need to Know

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Understanding how deductibles work is essential to managing your insurance costs and claims.

-

Definition: A deductible is the amount you must pay towards the cost of repairs before your insurance company pays the remaining balance.

-

Types of Deductibles: There are several types of deductibles, including:

- Collision Deductible: This deductible applies to repairs covered under your collision coverage, which typically covers damage to your vehicle resulting from an accident.

- Comprehensive Deductible: This deductible applies to repairs covered under your comprehensive coverage, which typically covers damage to your vehicle from non-collision events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Deductible: This deductible may apply if you are hit by an uninsured or underinsured driver, and you are seeking compensation for your damages.

-

Choosing a Deductible: When you purchase insurance, you typically have the option to choose your deductible amount. Common deductible amounts range from $0 to $1,000 or more.

-

Impact on Premiums: The deductible amount you choose will affect your insurance premiums. Generally, the higher your deductible, the lower your premiums, and vice versa.

-

When to Pay the Deductible: You will typically need to pay your deductible when you take your vehicle in for repairs. The repair shop will collect the deductible amount from you and then bill the insurance company for the remaining balance.

-

Deductible Reimbursement: In some cases, you may be able to recover your deductible. For example, if you are not at fault for the accident, you may be able to recover your deductible from the at-fault driver’s insurance company.

-

Waiver of Deductible: Some insurance policies may offer a waiver of deductible in certain situations, such as if you are hit by an uninsured driver or if the damage is caused by a natural disaster.

-

Understanding Policy Terms: Review your insurance policy carefully to understand the specific terms and conditions related to your deductible, including when it applies, how it is calculated, and whether it can be waived or reimbursed.

Understanding deductibles and how they work can help you make informed decisions about your insurance coverage and manage your out-of-pocket expenses. CARDIAGTECH.NET offers tools that can assist in estimating repair costs and assessing damage, helping you determine whether it is worth filing a claim based on your deductible amount.

9. Documenting Everything

Thorough documentation is critical throughout the entire insurance claims process. Keeping detailed records can help you protect your rights and ensure a fair outcome.

-

Accident Scene: At the accident scene, document everything possible:

- Photos: Take photos of the damage to all vehicles involved, the accident scene, and any relevant details like skid marks or traffic signals.

- Information Exchange: Exchange insurance and contact information with the other driver(s).

- Police Report: Obtain a copy of the police report, if one was filed.

- Witness Statements: If there were any witnesses, get their contact information and ask them to provide a written statement.

-

Communication with Insurance Company: Keep a record of all communication with the insurance company:

- Dates and Times: Note the date, time, and name of the person you spoke with for each phone call or meeting.

- Email Correspondence: Save all email correspondence with the insurance company.

- Written Records: Keep copies of all letters, faxes, and other written communication.

-

Repair Estimates: Obtain multiple repair estimates from different shops:

- Detailed Estimates: Make sure the estimates are detailed and include a breakdown of the parts and labor costs.

- Photos: Take photos of the damage before and after the repairs.

- Invoices: Keep copies of all invoices and receipts related to the repairs.

-

Medical Records: If you sustained any injuries in the accident, keep copies of all medical records and bills.

-

Other Expenses: Document any other expenses you incur as a result of the accident, such as rental car costs, towing fees, and lost wages.

-

Organization: Keep all of your documentation organized in a file or binder:

- Chronological Order: Arrange the documents in chronological order to make it easier to track the progress of your claim.

- Labels: Label each document clearly so you can quickly find what you need.

-

Backup: Make a backup of all your documentation, either electronically or by making copies.

Maintaining thorough documentation can help you prove your damages, support your claim, and protect your rights throughout the insurance claims process. CARDIAGTECH.NET offers tools that can assist in documenting vehicle damage and repair quality, providing valuable evidence to support your claim.

10. Seeking Professional Advice

Navigating the insurance claims process can be complex and overwhelming. Seeking professional advice from qualified experts can help you protect your rights and ensure a fair outcome.

-

Attorneys: An attorney who specializes in insurance claims can provide valuable legal advice and representation:

- Policy Review: An attorney can review your insurance policy and advise you on your rights and obligations.

- Claim Assistance: An attorney can help you file your claim and negotiate with the insurance company.

- Litigation: If the insurance company denies your claim or offers an unfair settlement, an attorney can represent you in court.

-

Public Adjusters: A public adjuster is a licensed professional who represents you in your claim:

- Claim Preparation: A public adjuster can help you prepare and document your claim.

- Negotiation: A public adjuster can negotiate with the insurance company on your behalf.

- Settlement: A public adjuster can help you reach a fair settlement with the insurance company.

-

Independent Appraisers: An independent appraiser can provide an unbiased assessment of the damage to your vehicle:

- Damage Assessment: An appraiser can inspect your vehicle and provide a detailed report of the damage.

- Repair Estimates: An appraiser can provide an independent repair estimate.

- Diminished Value Assessment: An appraiser can assess the diminished value of your vehicle after the repairs.

-

Mechanics: A qualified mechanic can provide an expert opinion on the condition of your vehicle and the quality of the repairs:

- Inspection: A mechanic can inspect your vehicle and identify any hidden damage or substandard repairs.

- Repair Recommendations: A mechanic can provide recommendations for repairing your vehicle.

-

Financial Advisors: A financial advisor can help you manage the financial aspects of your claim:

- Settlement Planning: A financial advisor can help you plan how to use your settlement money wisely.

- Tax Implications: A financial advisor can advise you on the tax implications of your settlement.

Seeking professional advice can help you navigate the complexities of the insurance claims process and ensure that you receive fair treatment. CARDIAGTECH.NET offers tools that can assist in assessing vehicle damage and repair quality, providing valuable information to share with your professional advisors.

Dealing with car insurance companies can be challenging, but understanding your rights and taking the right steps can make the process smoother. Remember to review your policy, document everything, and seek professional advice when needed.

Are you looking to equip your auto repair shop with the latest tools and technology? CARDIAGTECH.NET offers a wide range of diagnostic tools and equipment to help you accurately assess vehicle damage and provide high-quality repairs. Contact us today at +1 (641) 206-8880 or visit our website at CARDIAGTECH.NET. Our address is 276 Reock St, City of Orange, NJ 07050, United States. Let us help you enhance your shop’s efficiency and customer satisfaction. Click on the Whatsapp button and chat with our sales rep now.

FAQ: Can My Insurance Company Refuse to Fix My Car?

- Q1: Under what circumstances can my insurance company refuse to fix my car?

Your insurance company can refuse to fix your car if the damage is excluded under your policy, if your policy has lapsed, if you misrepresented information, if the repair costs exceed your policy limits, if liability is disputed, or if there is pre-existing damage.

- Q2: What should I do if my insurance claim is denied?

If your claim is denied, request a written explanation, review your policy, gather evidence, obtain a second opinion, file an appeal, contact the Department of Insurance, consider mediation or arbitration, and consult with an attorney if necessary.

- Q3: What is Actual Cash Value (ACV), and how does it affect my total loss settlement?

ACV is the fair market value of your vehicle immediately before the accident. It is used to determine the settlement amount if your vehicle is declared a total loss. Factors like age, mileage, condition, and market demand affect ACV.

- Q4: What is diminished value, and am I entitled to compensation for it?

Diminished value is the reduction in a vehicle’s market value resulting from damage and repair. You may be entitled to compensation if the accident was not your fault, your vehicle has been repaired, and it has suffered a loss in value due to the accident history.

- Q5: Do I have the right to choose my own repair shop?

Yes, in many jurisdictions, you have the right to choose your own repair shop, regardless of whether the insurance company recommends a particular shop.

- Q6: What is the difference between OEM and aftermarket parts, and can I request OEM parts for my repairs?

OEM parts are made by the original manufacturer, while aftermarket parts are made by third-party manufacturers. OEM parts are generally considered to be of higher quality. In many jurisdictions, you can request OEM parts, but you may need to pay the difference in cost.

- Q7: How does my deductible affect my insurance claim?

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. The deductible amount you choose will affect your insurance premiums.

- Q8: Why is documenting everything important during the insurance claims process?

Thorough documentation is critical for proving your damages, supporting your claim, and protecting your rights throughout the insurance claims process.

- Q9: What professionals can I seek advice from during the insurance claims process?

You can seek advice from attorneys, public adjusters, independent appraisers, mechanics, and financial advisors.

- Q10: How can CARDIAGTECH.NET help me in the insurance claims process?

CARDIAGTECH.NET offers tools that can assist in accurately assessing vehicle damage, documenting repair quality, and estimating repair costs, providing valuable evidence to support your claim. Contact us at +1 (641) 206-8880 or visit our website at CARDIAGTECH.NET.

Alt text: A car insurance claim being rejected with a document stamped “DENIED” symbolizing claim refusal.

Alt text: Reviewing car insurance policy document, highlighting coverage details and understanding policy terms.

Alt text: Photograph of car damage following accident, showing exterior dent and scratches.

Alt text: Frustrated man in insurance dispute, questioning coverage and seeking claim approval.

Alt text: Car repair shop interior view, equipped for automotive repairs and maintenance service.