How Long Does Insurance Take to Fix Your Car?

Navigating the aftermath of a car accident and wondering how long insurance takes to fix your car can be stressful. CARDIAGTECH.NET understands your concerns and is here to guide you through the process, ensuring you get back on the road quickly with top-notch auto repair services and the right tools to handle any repair situation. Let’s explore typical insurance timelines, factors that influence repair duration, and how to choose the best auto body shop to get your vehicle back to its pre-accident condition, all while equipping yourself with the best automotive tools available on CARDIAGTECH.NET.

1. Initial Assessment and Claim Filing

How long does it usually take to file an insurance claim after a car accident?

Filing an insurance claim should be done as soon as possible after a car accident, ideally within 24 to 72 hours. Prompt claim filing ensures faster processing and investigation of the incident. According to the Insurance Information Institute, quick reporting can help expedite the claims process and prevent potential delays due to forgotten details or disputes.

Filing a claim promptly achieves the following:

- Preserves Fresh Details: Reporting the accident quickly ensures that all details are fresh in your mind, which aids in accurate documentation.

- Facilitates Investigation: Insurance companies can start their investigation sooner, gathering evidence and interviewing witnesses while the information is readily available.

- Reduces Disputes: Prompt reporting minimizes the risk of conflicting accounts or disputes, leading to a smoother and faster resolution.

What documents and information are needed to file a car insurance claim?

To file a car insurance claim efficiently, gather the following documents and information:

- Policy Details: Your insurance policy number and contact information.

- Accident Details: Date, time, and location of the accident.

- Description of the Incident: A clear and concise account of what happened.

- Other Party Information: Name, contact details, and insurance information of the other driver(s) involved.

- Police Report: If available, include the police report number and details.

- Photos and Videos: Any visual evidence of the damage and accident scene.

- Witness Information: Names and contact details of any witnesses.

Having these details ready helps expedite the claim process and ensures accuracy. The more comprehensive your initial submission, the fewer follow-up requests from the insurance adjuster, which can save time.

How does the initial assessment by the insurance company work?

The initial assessment by the insurance company involves several key steps:

- Claim Review: The insurance company reviews the claim to verify policy coverage and assess the basic details of the accident.

- Assignment of Adjuster: An insurance adjuster is assigned to handle your claim. This adjuster will be your primary point of contact.

- Contact with Parties Involved: The adjuster will contact you, the other driver(s), and any witnesses to gather information and statements about the accident.

- Vehicle Inspection: The adjuster will inspect the damage to your vehicle. This can be done in person at a body shop or through photos and virtual assessments, depending on the insurance company’s policies and the extent of the damage.

- Damage Estimate: Based on the inspection, the adjuster creates an initial estimate of the repair costs.

This initial assessment is crucial for determining the next steps in the claims process. According to a report by J.D. Power, the speed and accuracy of this initial assessment significantly impact customer satisfaction with the overall claims experience.

2. Inspection and Damage Assessment

How long does the insurance adjuster usually take to inspect the car?

Typically, an insurance adjuster takes about 3 to 7 days to inspect the car after the claim has been filed. The exact time can vary based on several factors, including the adjuster’s workload, the complexity of the damage, and the location of the vehicle. According to industry data, urban areas may experience slightly longer wait times due to higher claim volumes.

What factors can delay the inspection process?

Several factors can contribute to delays in the inspection process:

- High Claim Volume: During peak seasons or after major weather events, insurance companies often experience a surge in claims, leading to longer wait times for inspections.

- Adjuster Availability: The availability of adjusters can be limited, especially in rural areas or during times when many adjusters are already handling multiple cases.

- Complexity of Damage: If the damage to your vehicle is extensive or complex, the adjuster may require more time to thoroughly assess the full extent of the repairs needed.

- Location of the Vehicle: If your vehicle is located far from the adjuster’s base or in a difficult-to-access location, it can take longer to schedule and complete the inspection.

- Disputes and Disagreements: Disagreements between the vehicle owner and the insurance company regarding the cause or extent of the damage can also delay the inspection process.

What is a “preferred” body shop, and why might an insurance company recommend one?

A “preferred” body shop is a repair facility that has a contractual agreement with the insurance company. Insurance companies recommend these shops for several reasons:

- Cost Control: Preferred shops often agree to lower labor rates and discounted parts prices in exchange for a steady stream of business from the insurance company.

- Streamlined Process: Working with preferred shops allows the insurance company to streamline the claims process, as they have established communication and payment protocols in place.

- Quality Assurance: Insurance companies often monitor the quality of work performed by preferred shops to ensure customer satisfaction and maintain standards.

However, remember that you have the right to choose any body shop you prefer. While preferred shops can offer convenience and potentially faster service, it’s essential to select a shop that you trust to provide high-quality repairs.

How to choose the right auto body shop

Choosing the right auto body shop is crucial for ensuring quality repairs and a smooth experience. Consider these factors:

- Certifications: Look for shops that are certified by reputable organizations or manufacturers. Certifications indicate that the shop meets certain standards for training, equipment, and quality of work. Cline Collision Center, for example, is OEM certified by Chrysler, Dodge, Fiat, Jeep, Ram, MOPAR, SRT, Ford, Hyundai, Infiniti, Nissan, Honda, and Acura.

- Reputation: Check online reviews and ask for recommendations from friends, family, or colleagues. A shop with consistently positive reviews is more likely to provide excellent service.

- Experience: Consider how long the shop has been in business and the experience of its technicians. An experienced shop is better equipped to handle a wide range of repairs.

- Warranty: Inquire about the shop’s warranty policy. A good shop will stand behind its work and offer a warranty on parts and labor.

- Customer Service: Pay attention to how you are treated when you visit or call the shop. A shop with friendly, professional staff is more likely to provide a positive overall experience.

- Estimates: Get a detailed, written estimate before authorizing any repairs. The estimate should include a breakdown of costs for parts, labor, and any additional services.

By carefully considering these factors, you can choose an auto body shop that meets your needs and provides high-quality repairs.

3. Repair Estimate and Approval

What does the repair estimate include, and how is it determined?

The repair estimate is a detailed breakdown of all costs associated with fixing your vehicle. It typically includes:

- Parts Costs: The cost of new or used parts needed for the repair.

- Labor Costs: The cost of the technician’s time to perform the repairs, including disassembly, reassembly, and any necessary adjustments.

- Materials Costs: The cost of materials such as paint, primer, and other consumables used during the repair process.

- Taxes: Any applicable sales tax on parts and labor.

- Additional Services: Costs for services such as towing, rental car, or detailing.

The estimate is determined by the body shop after a thorough inspection of the vehicle. They will assess the damage and consult industry-standard pricing guides to determine fair and accurate costs for parts and labor.

What if there are discrepancies between the body shop’s estimate and the insurance adjuster’s estimate?

Discrepancies between the body shop’s estimate and the insurance adjuster’s estimate are not uncommon. Here’s how to handle them:

- Review the Estimates: Carefully compare the two estimates to identify the specific areas of difference, such as parts costs, labor hours, or repair procedures.

- Communicate with the Body Shop and Adjuster: Discuss the discrepancies with both the body shop and the insurance adjuster to understand their reasoning and perspectives.

- Negotiate: Work with the body shop and adjuster to negotiate a compromise. The body shop may be able to provide additional documentation or justification for their estimate, while the adjuster may be willing to adjust their estimate based on new information.

- Independent Appraisal: If you cannot reach an agreement, you may have the option to request an independent appraisal. An independent appraiser will assess the damage and provide a neutral estimate that can be used to resolve the dispute.

- Policy Coverage Review: Review your insurance policy to understand your rights and coverage options. Some policies may include provisions for resolving disputes over repair costs.

How long does it take for the insurance company to approve the repair estimate?

The time it takes for an insurance company to approve the repair estimate can vary, but it generally takes between 2 to 5 business days. This timeline depends on:

- Complexity of the Estimate: More complex estimates with extensive damage and numerous line items may take longer to review.

- Adjuster Workload: The adjuster’s current workload can impact the speed of the approval process.

- Communication Efficiency: Clear and prompt communication between the body shop, the adjuster, and you can help expedite the process.

- Documentation: Providing all necessary documentation upfront, such as photos, repair estimates, and police reports, can help avoid delays.

To expedite the approval process, ensure that the body shop provides a detailed and accurate estimate, and maintain open communication with the adjuster to address any questions or concerns promptly.

4. The Car Repair Process

What are the typical steps involved in repairing a car after an accident?

The typical steps involved in repairing a car after an accident include:

- Initial Inspection and Estimate: The body shop inspects the vehicle and provides a detailed repair estimate.

- Insurance Approval: The insurance company reviews and approves the repair estimate.

- Parts Ordering: The body shop orders the necessary parts for the repair.

- Disassembly: Technicians disassemble the damaged areas of the vehicle to assess the full extent of the damage.

- Structural Repairs: Any necessary structural repairs are performed, such as frame straightening or welding.

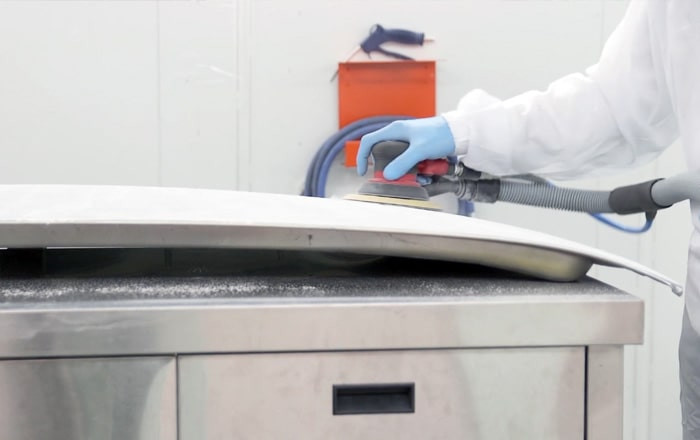

- Bodywork: Body panels are repaired or replaced, and the vehicle is prepped for painting.

- Painting: The vehicle is painted to match the original color.

- Reassembly: The vehicle is reassembled, including installing new parts and components.

- Mechanical Repairs: Any necessary mechanical repairs are performed, such as wheel alignment or suspension work.

- Quality Control: The repaired vehicle undergoes a thorough quality control inspection to ensure all repairs meet standards.

- Detailing: The vehicle is cleaned and detailed to restore its appearance.

How long does it generally take to repair a car after an accident?

The time it takes to repair a car after an accident varies depending on the extent of the damage:

- Minor Damage: Repairs for minor damage, such as scratches, dents, or bumper damage, may take 1 to 5 days.

- Moderate Damage: Repairs for moderate damage, such as body panel replacement or structural repairs, may take 1 to 4 weeks.

- Extensive Damage: Repairs for extensive damage, such as significant structural damage or multiple panel replacements, may take several weeks or even months.

According to data from Consumer Reports, the average car repair after an accident takes about two weeks. However, this can vary widely depending on the factors mentioned above.

What factors can affect the duration of the car repair process?

Several factors can influence how long it takes to repair a car after an accident:

- Extent of Damage: The more extensive the damage, the longer the repairs will take.

- Parts Availability: Delays in parts delivery can significantly prolong the repair process.

- Body Shop Workload: A busy body shop may take longer to complete repairs due to a higher volume of vehicles in their shop.

- Complexity of Repairs: Complex repairs, such as structural work or advanced technology repairs, require more time and expertise.

- Insurance Approval Delays: Delays in insurance approval or disagreements over the repair estimate can also extend the repair timeline.

How to stay informed about the progress of your car repair?

Staying informed about the progress of your car repair is essential for managing expectations and addressing any issues promptly. Here are some tips:

- Regular Communication: Maintain regular communication with the body shop. Ask for updates on the progress of the repairs and any potential delays.

- Photos and Documentation: Request photos or documentation of the repairs as they are being performed. This can help you understand the work being done and identify any potential issues.

- Online Tracking: Some body shops offer online tracking systems that allow you to monitor the progress of your repair in real-time.

- Scheduled Check-ins: Schedule regular check-ins with the body shop to discuss the progress of the repairs and address any questions or concerns.

- Document Everything: Keep a record of all communication, estimates, and invoices related to the repair.

By staying informed and proactive, you can help ensure a smooth and timely repair process.

5. Dealing with Delays and Additional Damage

What to do if the car repair is taking longer than expected?

If the car repair is taking longer than expected, take the following steps:

- Communicate with the Body Shop: Contact the body shop to inquire about the reason for the delay. Ask for a detailed explanation and an updated timeline for completion.

- Contact the Insurance Adjuster: If the delay is due to issues with insurance approval or parts procurement, contact the insurance adjuster to discuss the situation and seek assistance.

- Review the Repair Estimate: Review the original repair estimate to ensure that all agreed-upon repairs are being completed.

- Document Everything: Keep a record of all communication, explanations, and updated timelines related to the delay.

- Escalate if Necessary: If you are not satisfied with the explanation or progress, escalate the issue to a supervisor at the body shop or the insurance company.

What happens if additional damage is discovered during the repair process?

If additional damage is discovered during the repair process, the body shop will need to:

- Document the Additional Damage: The body shop will document the additional damage with photos and a written description.

- Notify the Insurance Adjuster: The body shop will notify the insurance adjuster of the additional damage and provide an updated repair estimate.

- Obtain Approval: The insurance adjuster will review the additional damage and approve the updated repair estimate. This may involve a reinspection of the vehicle.

- Proceed with Repairs: Once the updated estimate is approved, the body shop will proceed with the additional repairs.

This process may cause delays, so it’s important to maintain open communication with both the body shop and the insurance adjuster to ensure a smooth resolution.

How to negotiate with the insurance company if you disagree with their assessment or repair plan?

If you disagree with the insurance company’s assessment or repair plan, you have several options:

- Review Your Policy: Understand your policy coverage and your rights as a policyholder.

- Communicate Your Concerns: Clearly communicate your concerns to the insurance adjuster, providing specific reasons and supporting documentation.

- Obtain a Second Opinion: Get a second opinion from another body shop or independent appraiser.

- Negotiate: Be prepared to negotiate with the insurance company, providing evidence and justification for your position.

- Mediation or Arbitration: If you cannot reach an agreement through negotiation, consider mediation or arbitration, where a neutral third party helps resolve the dispute.

- Legal Action: As a last resort, you may consider taking legal action against the insurance company.

What are your rights as a customer when dealing with insurance repairs?

As a customer dealing with insurance repairs, you have several important rights:

- Right to Choose Your Body Shop: You have the right to choose any body shop you prefer to repair your vehicle.

- Right to a Fair and Accurate Estimate: You have the right to a fair and accurate repair estimate that reflects the full extent of the damage.

- Right to Quality Repairs: You have the right to have your vehicle repaired to its pre-accident condition, using quality parts and workmanship.

- Right to Be Informed: You have the right to be informed about the progress of the repairs and any potential delays.

- Right to Dispute: You have the right to dispute the insurance company’s assessment or repair plan if you disagree with it.

- Right to Legal Recourse: You have the right to take legal action against the insurance company if necessary.

6. Finalizing the Repair and Paperwork

What to check before accepting the repaired car?

Before accepting the repaired car, carefully inspect the following:

- Exterior: Check the exterior of the vehicle for any visible defects, such as mismatched paint, uneven panels, or scratches.

- Interior: Inspect the interior for any damage or missing components, such as trim pieces, seats, or electronics.

- Mechanical: Test the mechanical systems of the vehicle, such as the brakes, steering, and suspension, to ensure they are functioning properly.

- Electrical: Check the electrical systems, such as the lights, signals, and power windows, to ensure they are working correctly.

- Alignment: Verify that the wheels are properly aligned and that the vehicle tracks straight.

- Quality of Work: Ensure that all repairs have been completed to a high standard and that the vehicle looks and performs as it did before the accident.

What paperwork is needed to finalize the insurance claim and repair process?

To finalize the insurance claim and repair process, you will typically need the following paperwork:

- Repair Invoice: A detailed invoice from the body shop, outlining all repairs performed and costs incurred.

- Insurance Approval: Documentation from the insurance company approving the repair estimate and authorizing the repairs.

- Payment Authorization: A form authorizing the insurance company to pay the body shop directly or to reimburse you for the repairs.

- Release Form: A form releasing the insurance company from any further liability related to the accident.

- Warranty Information: Documentation outlining the warranty coverage for the repairs.

How to handle any remaining issues or concerns after the repair is completed?

If you have any remaining issues or concerns after the repair is completed, take the following steps:

- Communicate with the Body Shop: Contact the body shop to discuss your concerns and schedule a follow-up inspection.

- Contact the Insurance Adjuster: If the issues are related to the insurance claim, contact the insurance adjuster to discuss the situation and seek resolution.

- Document Everything: Keep a record of all communication, documentation, and follow-up actions related to the issues.

- Seek Legal Advice: If you are unable to resolve the issues through communication and negotiation, consider seeking legal advice from an attorney.

7. Speeding up the Process

How can you expedite the insurance claim process?

To expedite the insurance claim process:

- File Promptly: Report the accident and file your claim as soon as possible.

- Provide Accurate Information: Provide accurate and complete information when filing your claim.

- Cooperate with the Adjuster: Cooperate with the insurance adjuster and respond promptly to their requests for information or documentation.

- Choose a Reputable Body Shop: Select a reputable body shop with experience in handling insurance repairs.

- Maintain Communication: Stay in regular communication with the body shop and the insurance adjuster to monitor the progress of the repairs.

Are there any steps you can take to ensure a smoother repair experience?

To ensure a smoother repair experience:

- Choose the Right Body Shop: Select a certified and reputable body shop with positive reviews and a good track record.

- Get a Detailed Estimate: Obtain a detailed, written estimate before authorizing any repairs.

- Understand Your Policy: Understand your insurance policy coverage and your rights as a policyholder.

- Document Everything: Keep a record of all communication, estimates, and invoices related to the repair.

- Stay Informed: Stay informed about the progress of the repairs and address any issues promptly.

What role does the auto body shop play in speeding up the process?

The auto body shop plays a crucial role in speeding up the repair process by:

- Providing Accurate Estimates: Providing accurate and detailed repair estimates to the insurance company.

- Efficient Communication: Communicating efficiently with the insurance adjuster to obtain approval for the repairs.

- Timely Parts Ordering: Ordering parts promptly to minimize delays.

- Skilled Technicians: Employing skilled technicians who can perform repairs quickly and efficiently.

- Quality Control: Implementing quality control procedures to ensure that repairs are completed to a high standard, minimizing the need for rework.

- Customer Service: Providing excellent customer service and keeping you informed about the progress of the repairs.

CARDIAGTECH.NET is committed to providing you with the best tools and equipment to enhance your auto repair capabilities.

8. The Importance of Proper Tools and Equipment

How do the right tools and equipment affect repair time and quality?

The right tools and equipment significantly impact both the repair time and the quality of the work. Advanced diagnostic tools, precision measurement devices, and modern welding equipment enable technicians to perform repairs more efficiently and accurately. According to a study by the National Institute for Automotive Service Excellence (ASE), shops equipped with the latest technology can reduce repair times by up to 30% while also improving the quality of the repairs.

What essential tools should every auto body shop have?

Every auto body shop should have the following essential tools:

- Diagnostic Scanners: For identifying and diagnosing vehicle issues.

- Welding Equipment: For structural and body panel repairs.

- Frame Straighteners: For correcting structural damage.

- Paint Booths: For applying high-quality paint finishes.

- Measuring Tools: For precise alignment and measurements.

- Power Tools: Including grinders, sanders, and drills for efficient repairs.

Investing in these tools ensures that the shop can handle a wide range of repairs with speed and precision.

How can CARDIAGTECH.NET help auto body shops improve their efficiency and quality with the right tools?

CARDIAGTECH.NET offers a wide range of high-quality tools and equipment designed to improve the efficiency and quality of auto body repairs. Our products include advanced diagnostic scanners, welding equipment, frame straighteners, and measuring tools, all designed to meet the needs of modern auto body shops. By investing in tools from CARDIAGTECH.NET, auto body shops can:

- Reduce Repair Times: Advanced tools enable technicians to perform repairs more quickly and efficiently.

- Improve Repair Quality: Precision tools ensure accurate and high-quality repairs.

- Increase Customer Satisfaction: Faster and better repairs lead to happier customers.

- Boost Profitability: Increased efficiency and customer satisfaction translate into higher profits for the shop.

CARDIAGTECH.NET is your partner in enhancing your auto repair capabilities and achieving excellence in your work.

9. Case Studies and Examples

Real-life examples of insurance repair timelines

- Case Study 1: Minor fender bender with bumper damage.

- Timeline:

- Day 1: Accident reported, claim filed.

- Day 3: Insurance adjuster inspects the car.

- Day 5: Repair estimate approved.

- Day 8: Parts ordered and received.

- Day 10: Repairs completed.

- Total Time: 10 days

- Timeline:

- Case Study 2: Moderate collision with body panel damage and suspension issues.

- Timeline:

- Day 1: Accident reported, claim filed.

- Day 4: Insurance adjuster inspects the car.

- Day 7: Repair estimate approved.

- Day 12: Parts ordered and received.

- Day 25: Repairs completed.

- Total Time: 25 days

- Timeline:

- Case Study 3: Major accident with significant structural damage.

- Timeline:

- Day 1: Accident reported, claim filed.

- Day 5: Insurance adjuster inspects the car.

- Day 10: Repair estimate approved.

- Day 20: Parts ordered and received.

- Day 45: Repairs completed.

- Total Time: 45 days

- Timeline:

Factors that commonly cause delays

Common causes of delays in insurance repairs include:

- Parts Availability: Backordered or hard-to-find parts can significantly delay repairs.

- Insurance Approval Delays: Lengthy approval processes or disagreements over the repair estimate can extend the timeline.

- Additional Damage: Discovery of hidden damage during the repair process requires additional assessment and approval, causing delays.

- Body Shop Workload: A busy body shop may have longer wait times for repairs.

How proper communication can expedite the process

Proper communication between you, the body shop, and the insurance adjuster is crucial for expediting the repair process. Regular updates, clear explanations, and prompt responses to inquiries can help avoid misunderstandings and delays. According to a survey by the Claims and Litigation Management Alliance (CLM), claims with effective communication are resolved 20% faster than those without.

10. Frequently Asked Questions (FAQs)

How long does it take for an insurance company to fix my car after an accident?

The time it takes for an insurance company to fix your car can vary from a few days to several weeks, depending on the extent of the damage, parts availability, and the insurance company’s approval process. Minor repairs might take a week, while major repairs could take over a month.

What should I do immediately after a car accident to ensure a smooth insurance claim process?

Immediately after a car accident, ensure everyone is safe, exchange information with the other driver, document the scene with photos, and report the accident to your insurance company as soon as possible.

Can I choose any auto body shop, or do I have to use the insurance company’s preferred shop?

You have the right to choose any auto body shop you prefer. While insurance companies may recommend preferred shops, you are not obligated to use them.

What if the insurance company’s estimate is lower than the body shop’s estimate?

If the insurance company’s estimate is lower than the body shop’s, discuss the discrepancies with both parties. The body shop can provide justification for their estimate, and you can negotiate with the insurance company for a fair resolution.

How can I get a rental car while my car is being repaired?

Check your insurance policy for rental car coverage. If you have it, the insurance company will typically arrange for a rental car while your vehicle is being repaired.

What if additional damage is found during the repair process?

If additional damage is found, the body shop will notify the insurance company and request approval for the additional repairs. This may cause delays, but it’s necessary to ensure all damage is properly addressed.

How can I track the progress of my car repair?

Stay in regular communication with the auto body shop. Many shops provide updates via phone, email, or an online tracking system.

What should I look for when inspecting the repaired car before accepting it?

Inspect the car for any visible defects, mismatched paint, uneven panels, or mechanical issues. Ensure all repairs have been completed to a high standard before accepting the vehicle.

What paperwork do I need to finalize the insurance claim?

You will typically need the repair invoice, insurance approval, payment authorization, and a release form to finalize the insurance claim.

What are my rights if I’m not satisfied with the quality of the repairs?

If you are not satisfied with the quality of the repairs, communicate your concerns to the body shop and the insurance company. You have the right to have the repairs corrected to meet industry standards.

Conclusion

Understanding how long insurance takes to fix your car involves navigating several stages, from filing the initial claim to finalizing the repairs. By being proactive, staying informed, and choosing the right auto body shop, you can expedite the process and ensure a smoother experience. Remember, CARDIAGTECH.NET is here to support auto body shops with the best tools and equipment to enhance their efficiency and quality.

For top-quality auto repair tools and equipment, contact CARDIAGTECH.NET today. Visit us at 276 Reock St, City of Orange, NJ 07050, United States, or reach out via WhatsApp at +1 (641) 206-8880. Explore our website at CARDIAGTECH.NET to discover how we can help you excel in the auto repair industry.

Are you ready to equip your auto body shop with the best tools and equipment? Contact CARDIAGTECH.NET now for a consultation and discover how we can help you achieve excellence in your repairs. Don’t wait—upgrade your shop today and provide your customers with top-notch service!

Call to Action

Do you want to optimize your auto repair shop for efficiency and quality? Contact CARDIAGTECH.NET today for expert advice on the best tools and equipment to meet your needs. Our team is ready to assist you with tailored solutions that enhance your shop’s capabilities and improve customer satisfaction.

Contact Information:

- Address: 276 Reock St, City of Orange, NJ 07050, United States

- WhatsApp: +1 (641) 206-8880

- Website: CARDIAGTECH.NET