**Do You Compare Your Garage’s Financial Performance With That of Competitors?**

Do you compare your garage’s financial performance with that of competitors? Analyzing your garage’s financial health alongside that of your competitors is essential for strategic growth and sustained profitability. CARDIAGTECH.NET helps you get insights for better performance and financial forecasting. By using diagnostic tools from CARDIAGTECH.NET, you will see immediate improvements to financial benchmarking, revenue streams and profitability analysis.

1. Why Should You Compare Your Garage’s Financial Performance With Competitors?

Comparing your garage’s financial performance with that of competitors is critical for identifying strengths, weaknesses, and opportunities for improvement. This process, known as financial benchmarking, provides a clear understanding of your garage’s position in the market. By analyzing key performance indicators (KPIs) and financial metrics against industry averages and top performers, you can pinpoint areas where your garage excels and areas needing attention. Understanding these financial benchmarks and profitability analysis is a good strategy to achieve business growth.

Understanding Your Market Position

Benchmarking helps you understand where your garage stands relative to the competition. Are you outperforming, underperforming, or on par with others? This understanding is the first step in developing strategies to enhance your garage’s competitive edge.

Identifying Strengths and Weaknesses

By comparing financial metrics like revenue per service, cost of goods sold, and net profit margin, you can identify your garage’s strengths and weaknesses. For example, if your revenue per service is higher than the average, it indicates a strength in pricing or service quality. Conversely, a higher cost of goods sold might point to inefficiencies in supply chain management or purchasing practices.

Spotting Opportunities for Improvement

Benchmarking can reveal opportunities for improvement you might not have noticed otherwise. For instance, if competitors have a higher customer retention rate, it may indicate a need to improve your customer service or loyalty programs.

Data-Driven Decision Making

Instead of relying on gut feelings, comparing your financial performance against competitors allows you to make data-driven decisions. This objective approach minimizes risk and maximizes the potential for success.

Strategic Growth and Profitability

Ultimately, comparing your garage’s financial performance with competitors drives strategic growth and profitability. By addressing weaknesses, leveraging strengths, and capitalizing on opportunities, you can optimize your garage’s financial health and achieve sustainable success.

Financial Performance

Financial Performance

2. Key Financial Metrics to Compare

To conduct a thorough comparison, focus on specific financial metrics that offer meaningful insights into your garage’s performance. Here are some key metrics to consider:

Revenue per Service

Revenue per service measures the average revenue generated from each service performed. This metric reflects your pricing strategy and the perceived value of your services.

- Calculation: Total Service Revenue / Number of Services Performed

- Industry Average: According to industry reports, the average revenue per auto repair service ranges from $200 to $500, depending on the type of service and location.

- Benchmark: If your revenue per service is significantly lower, consider evaluating your pricing or service offerings.

Cost of Goods Sold (COGS)

COGS includes the direct costs associated with providing your services, such as parts, materials, and labor.

- Calculation: Beginning Inventory + Purchases – Ending Inventory

- Industry Average: The average COGS for auto repair shops typically falls between 50% and 70% of total revenue.

- Benchmark: A higher COGS than the industry average may indicate inefficiencies in purchasing or inventory management.

Gross Profit Margin

Gross profit margin indicates the profitability of your core services before considering operating expenses.

- Calculation: (Total Revenue – COGS) / Total Revenue * 100

- Industry Average: A healthy gross profit margin for auto repair shops is generally between 30% and 50%.

- Benchmark: A lower gross profit margin may suggest a need to re-evaluate pricing or reduce direct costs.

Operating Expenses

Operating expenses include all costs incurred to run your garage, such as rent, utilities, salaries, marketing, and administrative costs.

- Calculation: Total Operating Expenses

- Industry Average: Operating expenses typically range from 20% to 30% of total revenue.

- Benchmark: Tracking these expenses helps identify areas where you can cut costs and improve efficiency.

Net Profit Margin

Net profit margin is the ultimate measure of your garage’s profitability after all expenses are paid.

- Calculation: (Net Income / Total Revenue) * 100

- Industry Average: The average net profit margin for auto repair shops is between 5% and 15%.

- Benchmark: Comparing your net profit margin with industry averages reveals how efficiently your garage converts revenue into profit.

Customer Acquisition Cost (CAC)

CAC measures the cost of acquiring a new customer.

- Calculation: Total Marketing Expenses / Number of New Customers Acquired

- Industry Average: CAC can vary widely but generally falls between $50 and $200 per customer.

- Benchmark: Monitoring CAC helps optimize marketing spend and improve customer acquisition strategies.

Customer Retention Rate

Customer retention rate measures the percentage of customers who return for repeat business.

- Calculation: ((Number of Customers at End of Period – Number of New Customers Acquired During Period) / Number of Customers at Start of Period) * 100

- Industry Average: A good customer retention rate for auto repair shops is around 70% to 80%.

- Benchmark: High retention rates indicate strong customer loyalty and effective customer service.

Employee Productivity

Employee productivity measures the revenue generated per employee.

- Calculation: Total Revenue / Number of Employees

- Industry Average: Revenue per employee can vary significantly, but a general benchmark is $100,000 to $150,000 per employee.

- Benchmark: Improving employee productivity can significantly boost overall profitability.

3. How to Gather Competitive Financial Data

Gathering competitive financial data requires a combination of research, networking, and leveraging available resources.

Industry Associations

Many industry associations compile financial benchmarks and performance data. These reports often provide detailed insights into industry averages and best practices.

- Example: The Automotive Service Association (ASA) offers resources and data relevant to auto repair shops.

Market Research Reports

Market research firms conduct studies that include financial data on various industries. These reports can provide a comprehensive overview of the competitive landscape.

- Example: Reports from IBISWorld and Statista offer valuable industry-specific data.

Publicly Available Data

If your competitors are publicly traded companies, their financial statements are available to the public. These statements provide detailed financial information that can be used for benchmarking.

- Example: Use the SEC’s EDGAR database to access financial filings of publicly traded companies.

Networking

Attend industry events and network with other garage owners and managers. These connections can provide valuable insights and informal benchmarks.

- Tip: Join local or regional auto repair associations and attend their meetings.

Surveys and Questionnaires

Conduct surveys or questionnaires among your customers to gather information about their experiences with other garages. This feedback can provide insights into competitor pricing, service quality, and customer satisfaction.

- Tip: Use online survey tools like SurveyMonkey or Google Forms to collect data.

Professional Consultants

Hire a professional consultant specializing in the auto repair industry. These consultants have access to extensive databases and can provide tailored benchmarking reports.

- Tip: Look for consultants with a proven track record in the auto repair sector.

Competitive Financial Data

Competitive Financial Data

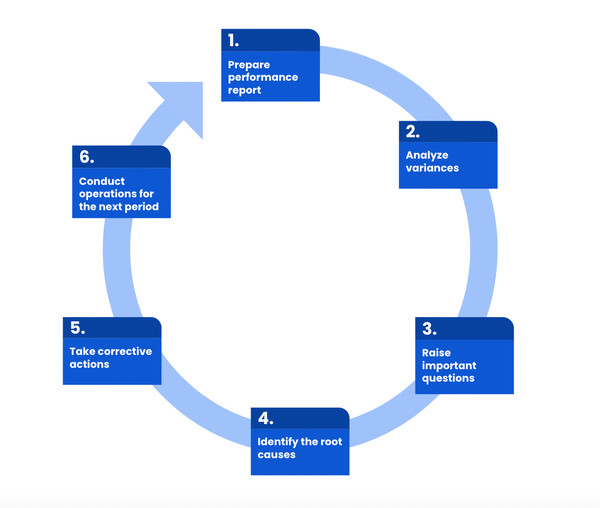

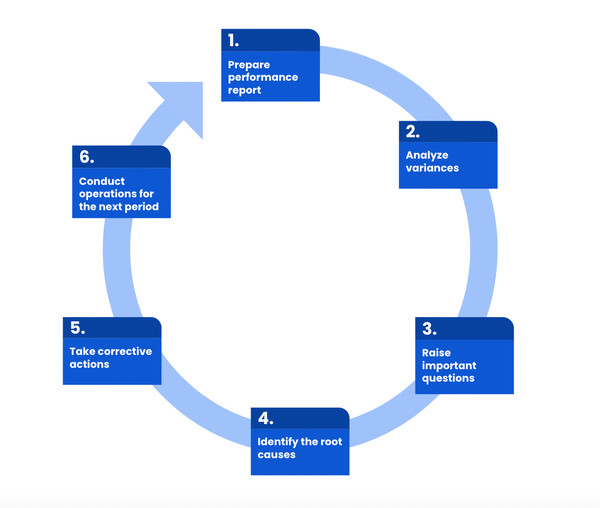

4. Step-by-Step Guide to Conducting a Financial Comparison

Follow these steps to effectively compare your garage’s financial performance with that of your competitors:

Step 1: Identify Your Competitors

Start by identifying your primary competitors. These are the garages that offer similar services to the same target market in your geographic area.

- Action: List at least three to five direct competitors.

Step 2: Gather Financial Data

Collect financial data for your garage and your competitors. Use the methods described above to gather this information.

- Action: Compile data on revenue, COGS, operating expenses, and other relevant metrics.

Step 3: Calculate Key Performance Indicators (KPIs)

Calculate the KPIs mentioned earlier, such as revenue per service, gross profit margin, and net profit margin, for your garage and your competitors.

- Action: Use a spreadsheet or financial software to calculate these metrics.

Step 4: Compare Your Performance

Compare your garage’s KPIs with those of your competitors and industry averages. Identify areas where you are outperforming, underperforming, or on par.

- Action: Create charts or graphs to visually compare your performance.

Step 5: Analyze Variances

Analyze the variances between your performance and that of your competitors. Determine the reasons for these differences.

- Action: Investigate the factors contributing to higher or lower performance.

Step 6: Develop an Action Plan

Based on your analysis, develop an action plan to address any weaknesses and capitalize on strengths. This plan should include specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Action: Outline steps to improve pricing, reduce costs, enhance customer service, or increase marketing effectiveness.

Step 7: Implement and Monitor

Implement your action plan and monitor your progress regularly. Track your KPIs to ensure you are achieving your goals.

- Action: Use financial software or spreadsheets to track your performance and make adjustments as needed.

Step 8: Regularly Update Your Benchmarks

Update your benchmarks regularly to stay informed about changes in the competitive landscape.

- Action: Conduct a financial comparison at least annually or more frequently if necessary.

5. Tools and Technologies for Financial Analysis

Leveraging the right tools and technologies can streamline the process of financial analysis and provide deeper insights.

Accounting Software

Accounting software like QuickBooks, Xero, and Sage can automate financial data collection and reporting.

- Benefit: These tools provide real-time financial data and customizable reports.

Spreadsheet Software

Spreadsheet software like Microsoft Excel and Google Sheets can be used to calculate KPIs, create charts, and perform variance analysis.

- Benefit: These tools offer flexibility and powerful analytical capabilities.

Financial Analysis Software

Financial analysis software like Fathom, PlanGuru, and Prophix provide advanced analytical tools and dashboards for in-depth financial analysis.

- Benefit: These tools offer sophisticated features for budgeting, forecasting, and performance monitoring.

Business Intelligence (BI) Tools

BI tools like Tableau and Power BI can visualize financial data and create interactive dashboards for easy analysis.

- Benefit: These tools enable data-driven decision-making and provide a comprehensive view of financial performance.

Diagnostic Tools from CARDIAGTECH.NET

Advanced diagnostic tools from CARDIAGTECH.NET can provide insights into the efficiency and effectiveness of your garage’s operations. By identifying issues early, you can reduce downtime, improve service quality, and enhance customer satisfaction.

- Benefit: These tools help optimize resource allocation and improve overall financial performance.

6. Common Pitfalls to Avoid When Comparing Financial Performance

Comparing your garage’s financial performance with competitors can be insightful, but it’s essential to avoid common pitfalls that can lead to inaccurate conclusions.

Comparing Apples to Oranges

Ensure that you are comparing businesses of similar size, service offerings, and target markets. Comparing a small, specialized garage to a large, full-service operation can be misleading.

- Solution: Focus on competitors that closely match your business model.

Relying on Incomplete Data

Using incomplete or outdated data can lead to inaccurate benchmarks.

- Solution: Ensure that your data is current and comprehensive.

Ignoring Qualitative Factors

Financial data tells only part of the story. Qualitative factors such as customer satisfaction, employee morale, and brand reputation also impact financial performance.

- Solution: Consider qualitative factors alongside financial data.

Overlooking Regional Differences

Financial performance can vary significantly by geographic region due to differences in labor costs, rent, and market demand.

- Solution: Compare your garage to competitors in your specific region.

Failing to Account for Economic Conditions

Economic conditions such as recessions or booms can impact financial performance across the industry.

- Solution: Consider the economic climate when interpreting financial data.

Not Seeking Expert Advice

Interpreting financial data and developing effective strategies can be challenging.

- Solution: Consult with a financial advisor or industry expert for guidance.

7. Case Studies: Successful Financial Comparisons

Examining real-world examples can provide valuable insights into how to conduct effective financial comparisons.

Case Study 1: Identifying Pricing Opportunities

A local auto repair shop compared its revenue per service with that of its competitors and discovered that it was significantly lower. After analyzing its pricing structure and service offerings, the shop increased its prices on certain services and introduced premium service packages. As a result, the shop’s revenue per service increased by 15%, boosting overall profitability.

Case Study 2: Reducing Costs Through Benchmarking

A garage compared its cost of goods sold with industry averages and found that it was higher than the benchmark. The garage reviewed its purchasing practices and negotiated better deals with suppliers. Additionally, it implemented an inventory management system to reduce waste and improve efficiency. These efforts reduced the garage’s COGS by 10%, significantly improving its gross profit margin.

Case Study 3: Improving Customer Retention

An auto repair shop compared its customer retention rate with that of its competitors and discovered that it was lower than the benchmark. The shop implemented a customer loyalty program, offered discounts for repeat business, and improved its customer service. As a result, the shop’s customer retention rate increased by 20%, leading to higher revenue and profitability.

Case Study 4: Enhancing Employee Productivity

A garage compared its revenue per employee with industry averages and found that it was lower than the benchmark. The garage invested in training and development programs for its employees, provided them with better tools and equipment, and implemented a performance-based incentive system. These efforts increased the garage’s revenue per employee by 25%, significantly improving its overall financial performance.

8. The Role of CARDIAGTECH.NET in Improving Garage Financial Performance

CARDIAGTECH.NET offers a range of diagnostic tools and equipment that can significantly improve your garage’s financial performance.

Advanced Diagnostic Tools

CARDIAGTECH.NET’s advanced diagnostic tools enable your technicians to quickly and accurately diagnose vehicle issues. This reduces diagnostic time, improves service quality, and enhances customer satisfaction.

- Benefit: Faster and more accurate diagnostics lead to increased efficiency and higher revenue per service.

Efficient Repair Equipment

CARDIAGTECH.NET provides efficient and reliable repair equipment that helps your technicians perform repairs quickly and effectively. This reduces labor costs and increases the number of services your garage can perform.

- Benefit: Reduced labor costs and increased service volume boost overall profitability.

Training and Support

CARDIAGTECH.NET offers training and support to help your technicians use the diagnostic tools and equipment effectively. This ensures that your team is equipped with the knowledge and skills to provide high-quality services.

- Benefit: Well-trained technicians deliver better service, leading to increased customer satisfaction and repeat business.

Inventory Management Solutions

CARDIAGTECH.NET’s inventory management solutions help you track your parts and supplies efficiently. This reduces waste, minimizes downtime, and ensures that you always have the parts you need on hand.

- Benefit: Efficient inventory management reduces costs and improves operational efficiency.

Enhanced Customer Satisfaction

By using CARDIAGTECH.NET’s tools and equipment, you can provide faster, more accurate, and more reliable services. This leads to increased customer satisfaction, which drives repeat business and positive word-of-mouth referrals.

- Benefit: Satisfied customers are more likely to return and recommend your garage to others, leading to higher revenue and profitability.

9. Future Trends in Garage Financial Analysis

The field of financial analysis is constantly evolving, and several trends are poised to shape the future of garage financial management.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies can automate financial analysis, identify patterns, and provide predictive insights. These tools can help garages make more informed decisions and improve their financial performance.

- Example: AI-powered financial analysis software can predict future revenue based on historical data and market trends.

Cloud-Based Financial Management

Cloud-based financial management solutions offer greater flexibility, scalability, and accessibility. These tools enable garages to manage their finances from anywhere, at any time.

- Example: Cloud-based accounting software allows you to access your financial data from your computer, tablet, or smartphone.

Big Data Analytics

Big data analytics can provide deeper insights into financial performance by analyzing large volumes of data from various sources. These insights can help garages identify opportunities for improvement and optimize their operations.

- Example: Analyzing customer data to identify the most profitable services and target marketing efforts accordingly.

Real-Time Financial Dashboards

Real-time financial dashboards provide a comprehensive view of your garage’s financial performance. These dashboards allow you to track KPIs, monitor trends, and make timely decisions.

- Example: A dashboard that displays revenue, expenses, and profit margins in real-time, allowing you to quickly identify and address any issues.

Integration with Other Business Systems

Integrating financial management systems with other business systems, such as customer relationship management (CRM) and enterprise resource planning (ERP), can streamline processes and improve data accuracy.

- Example: Integrating your accounting software with your CRM system to track customer spending and identify high-value customers.

10. Actionable Strategies to Improve Your Garage’s Financial Health

Based on your financial comparison, implement these actionable strategies to improve your garage’s financial health:

Optimize Pricing

Review your pricing strategy and adjust prices as needed to align with market rates and reflect the value of your services.

- Action: Conduct a pricing analysis and adjust prices based on competitor rates and customer feedback.

Reduce Costs

Identify areas where you can cut costs, such as negotiating better deals with suppliers, reducing waste, and improving energy efficiency.

- Action: Implement cost-saving measures and track your progress regularly.

Enhance Customer Service

Improve customer service to increase customer satisfaction and retention.

- Action: Implement a customer loyalty program, solicit feedback, and address any complaints promptly.

Increase Marketing Effectiveness

Optimize your marketing efforts to attract new customers and drive repeat business.

- Action: Develop a targeted marketing plan and track your results.

Improve Employee Productivity

Invest in training and development programs for your employees to enhance their skills and productivity.

- Action: Provide training opportunities and implement a performance-based incentive system.

Manage Inventory Efficiently

Implement an inventory management system to track your parts and supplies efficiently.

- Action: Use inventory management software and conduct regular inventory audits.

Monitor Financial Performance Regularly

Track your financial performance regularly and make adjustments as needed to stay on track toward your goals.

- Action: Use financial software or spreadsheets to monitor your KPIs and track your progress.

Improve Garage's Financial Health

Improve Garage's Financial Health

FAQ: Comparing Garage Financial Performance

1. Why is it important to compare my garage’s financial performance with competitors?

Comparing your garage’s financial performance with competitors helps you understand your market position, identify strengths and weaknesses, and spot opportunities for improvement, leading to strategic growth and profitability.

2. What key financial metrics should I compare?

Key financial metrics to compare include revenue per service, cost of goods sold (COGS), gross profit margin, operating expenses, net profit margin, customer acquisition cost (CAC), customer retention rate, and employee productivity.

3. How can I gather financial data on my competitors?

You can gather financial data through industry associations, market research reports, publicly available data, networking, surveys and questionnaires, and professional consultants.

4. What are some common pitfalls to avoid when comparing financial performance?

Common pitfalls include comparing dissimilar businesses, relying on incomplete data, ignoring qualitative factors, overlooking regional differences, failing to account for economic conditions, and not seeking expert advice.

5. How can CARDIAGTECH.NET help improve my garage’s financial performance?

CARDIAGTECH.NET offers advanced diagnostic tools, efficient repair equipment, training and support, inventory management solutions, and enhanced customer satisfaction, all of which can significantly improve your garage’s financial performance.

6. What future trends should I be aware of in garage financial analysis?

Future trends include the use of artificial intelligence (AI) and machine learning (ML), cloud-based financial management, big data analytics, real-time financial dashboards, and integration with other business systems.

7. What are some actionable strategies to improve my garage’s financial health?

Actionable strategies include optimizing pricing, reducing costs, enhancing customer service, increasing marketing effectiveness, improving employee productivity, managing inventory efficiently, and monitoring financial performance regularly.

8. How often should I compare my garage’s financial performance with competitors?

You should conduct a financial comparison at least annually or more frequently if necessary to stay informed about changes in the competitive landscape.

9. What tools and technologies can help with financial analysis?

Tools and technologies include accounting software, spreadsheet software, financial analysis software, business intelligence (BI) tools, and diagnostic tools from CARDIAGTECH.NET.

10. How can I ensure that my financial comparison is accurate and meaningful?

Ensure accuracy by comparing similar businesses, using complete and current data, considering qualitative factors, accounting for regional differences and economic conditions, and seeking expert advice when needed.

Improving your garage’s financial health requires a strategic approach, continuous monitoring, and a willingness to adapt to changing market conditions. By comparing your performance with that of your competitors and implementing actionable strategies, you can achieve sustainable success and profitability. CARDIAGTECH.NET is here to support you with the tools and resources you need to thrive in the competitive auto repair industry.

Ready to take your garage’s financial performance to the next level? Contact CARDIAGTECH.NET today for expert advice and cutting-edge diagnostic solutions. Our team is here to help you identify areas for improvement, optimize your operations, and achieve your financial goals. Don’t wait – contact us now and see the difference CARDIAGTECH.NET can make for your business.

Contact Information:

- Address: 276 Reock St, City of Orange, NJ 07050, United States

- WhatsApp: +1 (641) 206-8880

- Website: CARDIAGTECH.NET

Don’t let your garage fall behind the competition. Take control of your financial future with CARDIAGTECH.NET today!