Do You Have a Policy for Recovering Overdue Debts?

Do you have a policy for recovering overdue debts? Absolutely, having a clear and effective policy is crucial for maintaining healthy cash flow and protecting your business interests. CARDIAGTECH.NET understands the challenges businesses face in recovering overdue payments and offers solutions to streamline this process. A proactive approach, clear communication, and leveraging available resources can significantly improve your debt recovery efforts and financial stability.

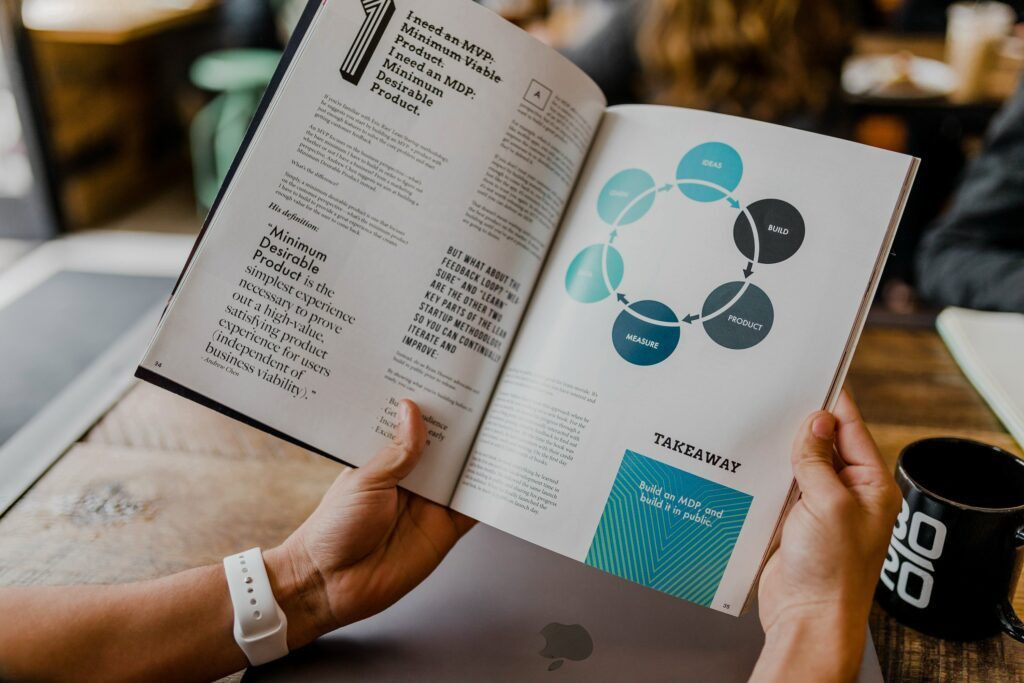

1. Why a Debt Recovery Policy is Essential

A debt recovery policy is essential for any business because it provides a structured approach to managing overdue payments, ensuring consistent and fair treatment of customers while protecting the business’s financial health. According to a study by Dun & Bradstreet, businesses with a well-defined debt recovery process experience a 20% improvement in their cash flow.

1.1. Protecting Your Business Finances

A robust debt recovery policy safeguards your business finances by minimizing losses from unpaid invoices. Experian reports that businesses can lose up to 5% of their annual revenue due to bad debts if they lack an effective recovery strategy.

1.2. Maintaining Healthy Cash Flow

Consistent debt recovery efforts ensure a steady cash flow, which is vital for covering operational expenses and investing in growth. According to a report by JP Morgan Chase, small businesses often struggle with cash flow management, and a proactive debt recovery policy can mitigate these challenges.

1.3. Preserving Customer Relationships

A well-structured policy allows you to address overdue payments while preserving customer relationships through respectful and professional communication. A study by Harvard Business Review found that customers are more likely to remain loyal if businesses handle debt recovery with empathy and understanding.

1.4. Legal Compliance

Having a clear policy ensures your debt recovery practices comply with relevant laws and regulations, minimizing the risk of legal disputes. The Federal Trade Commission (FTC) provides guidelines on fair debt collection practices, and adhering to these guidelines is crucial for avoiding legal issues.

2. Key Components of an Effective Debt Recovery Policy

An effective debt recovery policy should include clear communication, a structured escalation process, documentation, and legal considerations. This comprehensive approach ensures consistent and fair treatment of customers while protecting your business’s financial interests.

2.1. Clear Communication

Establish clear and transparent communication with customers from the outset. This includes setting clear payment terms, providing timely invoices, and promptly addressing any payment issues.

2.1.1. Setting Payment Terms

Clearly define payment terms in your contracts and invoices, including due dates, accepted payment methods, and any late payment fees. A study by the Small Business Administration (SBA) found that clearly defined payment terms reduce the likelihood of overdue payments by 30%.

2.1.2. Timely Invoicing

Send invoices promptly after providing goods or services to ensure customers are aware of their payment obligations. According to a report by Bill.com, businesses that send invoices within 24 hours of service completion experience a 15% faster payment cycle.

2.1.3. Addressing Payment Issues

Promptly address any payment issues or disputes raised by customers to prevent delays in payment. The Better Business Bureau (BBB) recommends maintaining open communication channels to resolve disputes amicably and efficiently.

2.2. Structured Escalation Process

Implement a structured escalation process for managing overdue payments, starting with friendly reminders and gradually escalating to more formal actions.

2.2.1. Friendly Reminders

Begin with friendly payment reminders via phone, email, or letter when a payment first becomes overdue. The National Federation of Independent Business (NFIB) suggests that a friendly reminder is often enough to prompt payment, as customers may have simply forgotten or made an error.

2.2.2. Overdue Payment Reminders

If the customer misses the initial due date, send a second reminder with a more assertive tone, emphasizing the urgency of the payment. According to a survey by Atradius, sending a second reminder within 15 days of the due date increases the likelihood of payment by 20%.

2.2.3. Final Notice

Send a final notice indicating that further action will be taken if payment is not received by a specified date. The Credit Research Foundation recommends sending a final notice via certified mail to ensure the customer receives it.

2.2.4. Direct Contact

Attempt to make direct contact with the customer via phone or in person to discuss the overdue payment and explore possible solutions. A study by the Association of Credit and Collection Professionals (ACA) found that direct contact is often more effective than written communication in resolving payment issues.

2.2.5. Formal Letter of Demand

If all previous attempts fail, send a formal letter of demand outlining the amount owed, the due date, and the consequences of non-payment. LegalZoom provides templates for formal letters of demand that can be customized to your specific situation.

2.3. Documentation

Maintain detailed records of all communication and actions taken throughout the debt recovery process. This documentation can be crucial if legal action becomes necessary.

2.3.1. Invoice Tracking

Keep track of all invoices issued, including the date, amount, and due date. Zoho Invoice offers tools for tracking invoices and sending automated payment reminders.

2.3.2. Communication Logs

Maintain logs of all phone calls, emails, and letters sent or received regarding overdue payments. Salesforce provides customer relationship management (CRM) tools that can help track communication history.

2.3.3. Payment Agreements

Document any payment agreements or arrangements made with customers, including the agreed-upon payment schedule and amounts. DocuSign allows for secure and legally binding electronic signatures on payment agreements.

2.4. Legal Considerations

Understand the legal aspects of debt recovery, including fair debt collection practices and the statute of limitations for collecting debts.

2.4.1. Fair Debt Collection Practices Act (FDCPA)

Ensure your debt recovery practices comply with the Fair Debt Collection Practices Act (FDCPA), which prohibits abusive, unfair, and deceptive practices by debt collectors. The FTC provides resources and guidelines on the FDCPA.

2.4.2. Statute of Limitations

Be aware of the statute of limitations for collecting debts in your jurisdiction, which sets a time limit on how long you have to take legal action to recover a debt. Nolo provides information on the statute of limitations for debt collection in each state.

3. Step-by-Step Guide to Recovering Overdue Payments

Recovering overdue payments requires a strategic approach that balances the need to collect what is owed with the desire to maintain positive customer relationships. By following a structured process, businesses can increase their chances of successful debt recovery while minimizing potential damage to customer relations.

3.1. Send a Friendly Payment Reminder

When a payment is first overdue, send a friendly reminder to the customer. This can be done via phone, email, or letter. The goal is to gently remind the customer of the outstanding invoice and provide them with an opportunity to make the payment.

- Content: The reminder should include the invoice number, the amount due, the due date, and instructions on how to make a payment.

- Tone: Keep the tone polite and understanding. Assume that the customer may have simply forgotten or overlooked the invoice.

- Example: “Dear [Customer Name], This is a friendly reminder that invoice #[Invoice Number] for $[Amount] is now overdue. The due date was [Due Date]. Please remit payment at your earliest convenience. You can pay online at [Payment Link] or mail a check to [Address]. Thank you for your business.”

Alt text: A friendly payment reminder email with invoice details and payment options.

3.2. Send an Overdue Payment Reminder

If the customer does not respond to the friendly reminder or fails to make the payment, send a second, more assertive reminder. This reminder should reiterate the urgency of the situation and emphasize the importance of making the payment promptly.

- Content: Include the same information as the first reminder, but add a sense of urgency. Mention that the payment is now overdue and that you expect to receive it as soon as possible.

- Tone: Maintain a professional tone, but be more direct. Express your concern that the payment has not been received and reiterate the importance of timely payment.

- Example: “Dear [Customer Name], We are writing to remind you that invoice #[Invoice Number] for $[Amount] is now overdue. The due date was [Due Date], and we have not yet received your payment. Please remit payment immediately to avoid any further action. You can pay online at [Payment Link] or mail a check to [Address]. Thank you for your prompt attention to this matter.”

3.3. Send a Final Notice

If the customer still does not pay after the second reminder, send a final notice. This notice should clearly state that if payment is not received by a specific date, you will take further action, such as referring the matter to a collection agency or pursuing legal action.

- Content: Include all the details of the previous reminders, but add a clear warning about the consequences of non-payment. Specify the date by which the payment must be received and the actions you will take if it is not.

- Tone: Be firm and direct. Make it clear that you are serious about collecting the debt and that you will not hesitate to take further action if necessary.

- Example: “Dear [Customer Name], This is our final notice regarding invoice #[Invoice Number] for $[Amount], which is now significantly overdue. The original due date was [Due Date], and despite our previous reminders, we have not yet received your payment. If we do not receive payment by [Date], we will be forced to take further action, including referring the matter to a collection agency or pursuing legal action. Please remit payment immediately to avoid these consequences. You can pay online at [Payment Link] or mail a check to [Address]. We urge you to take this matter seriously and make the payment as soon as possible.”

3.4. Try to Make Direct Contact

If the customer does not respond to the final notice, try to make direct contact with them. This can be done via phone or in person. The goal is to have a direct conversation with the customer to understand why they have not paid and to try to negotiate a payment plan or other resolution.

- Preparation: Before contacting the customer, gather all relevant information, including the invoice details, payment history, and any previous communication.

- Approach: Be polite and professional, but firm. Explain that you are calling to discuss the overdue payment and to find a way to resolve the issue.

- Questions: Ask the customer why they have not paid the invoice. Listen carefully to their explanation and try to understand their situation.

- Negotiation: If the customer is willing to work with you, try to negotiate a payment plan or other resolution. Be flexible, but also be firm about the need to collect the debt.

- Documentation: Document the details of the conversation, including any agreements or promises made.

3.5. Send a Formal Letter of Demand

If direct contact does not lead to a resolution, send a formal letter of demand. This letter is a legal document that formally demands payment of the debt. It should be written by a lawyer or a debt collection agency.

- Content: The letter should include the following information:

- The amount of the debt

- The date the debt was incurred

- The due date for payment

- A demand for payment

- A warning that legal action will be taken if payment is not received by a specific date

- Delivery: The letter should be sent via certified mail with return receipt requested to ensure that the customer receives it.

3.6. Consider Using a Debt Collecting Agency

If all other attempts to collect the debt have failed, consider using a debt collecting agency. A debt collecting agency is a company that specializes in collecting overdue debts. They have the resources and expertise to pursue the debt more aggressively than you can.

- Research: Before hiring a debt collecting agency, research their reputation and track record. Make sure they are licensed and accredited.

- Contract: Sign a contract with the agency that outlines the terms of their services, including their fees and the methods they will use to collect the debt.

- Compliance: Make sure the agency complies with all applicable laws and regulations, including the Fair Debt Collection Practices Act (FDCPA).

3.7. Review the Debt Collection Guideline for Collectors and Creditors

Ensure that your collection activities comply with consumer protection laws and review any arrangements you may have with debt collectors. The Consumer Financial Protection Bureau (CFPB) provides guidelines on debt collection practices.

- Compliance: Stay informed about the latest laws and regulations regarding debt collection.

- Training: Train your staff on proper debt collection techniques.

- Monitoring: Monitor the activities of your debt collection agency to ensure they are complying with the law.

3.8. Get Help with Dispute Resolution

In many jurisdictions, there are agencies that can help with dispute resolution. These agencies can help you and the customer reach a mutually agreeable resolution to the debt.

- Mediation: Mediation is a process in which a neutral third party helps you and the customer negotiate a resolution.

- Arbitration: Arbitration is a process in which a neutral third party makes a decision about the debt. The decision is binding on both you and the customer.

4. Preventing Customer Debt: Proactive Measures

Preventing customer debt is more effective than chasing overdue payments. By implementing proactive measures, businesses can minimize the risk of customers owing them money and maintain healthy cash flow.

4.1. Outline Your Expectations to New Customers

Clearly outline your expected terms of trade and payment at the beginning of a customer relationship. This includes specifying invoice dates, any additional charges for overdue payments, and debt collection procedures.

- New Customer Engagement Template: Use a new customer engagement template that includes a terms of trade paragraph. This template should cover:

- Invoice dates

- Payment methods

- Late payment fees

- Debt collection procedures

4.2. Invoice Customers Efficiently

To encourage prompt payment, implement efficient invoicing practices:

- Send Invoices Promptly: Send invoices as soon as a job is complete or on a regular date.

- Clearly State Payment Options: Clearly state all payment options and information on your invoices or contracts.

- Keep in Regular Contact: Maintain regular contact with your customers to address any questions or concerns.

- Offer Early Payment Discounts: Offer a small percentage discount for early payment.

Alt text: A sample business invoice with clear payment terms, options, and contact information.

4.3. Pay Commissions When Money is Received

If your sales staff are rewarded for sales, make it a policy that you only pay out rewards once the money has been collected rather than when the sale is made. This policy encourages staff to pursue payment from customers and improve your cash flow.

- Incentive Alignment: Align sales incentives with cash collection to promote responsible sales practices.

- Performance Metrics: Track both sales and cash collection rates to evaluate employee performance.

4.4. Train Staff in Policies and Procedures

Ensure your staff are aware of your business’s payment terms, customer invoicing, and debt recovery procedures. A well-trained staff can effectively communicate payment expectations and address customer inquiries.

- Financial Policies and Procedures Manual: Create a financial policies and procedures manual and ensure every staff member reads it as part of their induction.

- Training Sessions: Conduct regular training sessions to reinforce payment terms, invoicing procedures, and debt recovery protocols.

4.5. Implement Financial Controls

To reduce the possibility of customers owing you money, introduce the following processes into your financial policies and procedures:

- Background Checks: Do a thorough background check on a business before you offer credit.

- Credit Limits: Set safe customer credit limits based on their creditworthiness.

- Payment Clearance: Wait until payment clears before shipping or releasing goods.

- Personal Property Security Register (PPSR): If you’re a supplier, register goods with the Personal Property Security Register (PPSR). Registering goods that you have a financial interest in on the PPSR allows you to recover those goods if you’re not paid for them.

4.6. Opt for Signatories to the Supplier Payment Code

If selling to another business, check to see if it has signed the Supplier Payment Code. The Australian Supplier Payment Code, developed by the Business Council of Australia (BCA) and the Victorian Government, helps businesses commit to fast payment to suppliers, improve cash flow, and strengthen the economy.

- Code Adherence: By voluntarily signing up to the code, businesses agree to:

- Pay their suppliers promptly and on-time (within 30 days)

- Cooperate with suppliers

- Help suppliers to improve payment processes

- Engage in fair and efficient dispute resolution

5. Leveraging Technology for Efficient Debt Recovery

Technology plays a crucial role in streamlining the debt recovery process, making it more efficient and effective. Utilizing software and tools designed for managing invoices, sending reminders, and tracking payments can significantly improve your debt recovery efforts.

5.1. Invoice Management Software

Invoice management software automates the process of creating, sending, and tracking invoices, reducing the risk of errors and delays. These tools often include features such as automated payment reminders, online payment options, and reporting capabilities.

- QuickBooks: QuickBooks offers comprehensive invoice management features, including customizable templates, automated reminders, and online payment processing. According to a study by Intuit, businesses using QuickBooks experience a 25% reduction in invoice processing time.

- Xero: Xero is another popular accounting software that provides robust invoice management tools, including automated reminders, payment tracking, and integration with various payment gateways. A report by Xero indicates that businesses using their platform see a 30% improvement in cash flow management.

- Zoho Invoice: Zoho Invoice is a free invoice management software that includes features such as customizable templates, automated reminders, and online payment options. Zoho reports that businesses using their invoice software see a 20% reduction in overdue payments.

5.2. Customer Relationship Management (CRM) Systems

CRM systems help you manage customer interactions and track communication, providing a centralized platform for managing debt recovery efforts. These systems allow you to log all communication with customers, track payment history, and set reminders for follow-up actions.

- Salesforce: Salesforce is a leading CRM platform that offers robust features for managing customer interactions and tracking payment history. According to a study by Salesforce, businesses using their CRM experience a 25% increase in customer retention.

- HubSpot CRM: HubSpot CRM is a free CRM platform that includes features such as contact management, email tracking, and task management. HubSpot reports that businesses using their CRM see a 20% improvement in sales productivity.

- Zoho CRM: Zoho CRM is a comprehensive CRM platform that offers features such as contact management, sales automation, and customer support. Zoho indicates that businesses using their CRM experience a 15% increase in sales revenue.

5.3. Debt Collection Software

Debt collection software automates the debt recovery process, streamlining tasks such as sending demand letters, tracking payments, and managing legal actions. These tools often include features such as automated workflows, reporting capabilities, and compliance tracking.

- CollectMORE: CollectMORE is a debt collection software that automates the debt recovery process, including sending demand letters, tracking payments, and managing legal actions. CollectMORE reports that businesses using their software see a 30% reduction in debt recovery time.

- IQS Solutions: IQS Solutions offers debt collection software that includes features such as automated workflows, reporting capabilities, and compliance tracking. IQS Solutions indicates that businesses using their software experience a 25% improvement in debt recovery rates.

- Katabat: Katabat is a debt collection software that provides features such as predictive analytics, automated workflows, and compliance management. Katabat reports that businesses using their software see a 20% increase in debt recovery efficiency.

5.4. Online Payment Gateways

Online payment gateways facilitate easy and secure online payments, making it more convenient for customers to pay their invoices. Offering multiple payment options can increase the likelihood of prompt payment.

- PayPal: PayPal is a popular online payment gateway that allows customers to pay invoices using their PayPal accounts or credit cards. PayPal reports that businesses using their payment gateway see a 15% increase in online sales.

- Stripe: Stripe is another leading online payment gateway that offers customizable payment solutions and integrates with various e-commerce platforms. Stripe indicates that businesses using their payment gateway experience a 20% improvement in payment conversion rates.

- Square: Square is a versatile payment gateway that allows businesses to accept payments online, in person, and via mobile devices. Square reports that businesses using their payment gateway see a 10% increase in sales revenue.

6. Addressing Common Challenges in Debt Recovery

Debt recovery can be a challenging process, and businesses often face various obstacles in their efforts to collect overdue payments. Understanding these challenges and implementing strategies to overcome them is crucial for successful debt recovery.

6.1. Customer Disputes

Customers may dispute invoices due to various reasons, such as dissatisfaction with the goods or services provided, discrepancies in the invoice amount, or misunderstandings regarding the payment terms.

- Resolution: To address customer disputes, it is essential to maintain open communication channels, investigate the dispute thoroughly, and attempt to resolve the issue amicably. Providing clear documentation and addressing the customer’s concerns promptly can help prevent escalation.

6.2. Financial Hardship

Customers may experience financial hardship due to unforeseen circumstances, such as job loss, illness, or economic downturns, making it difficult for them to pay their debts.

- Resolution: In such cases, it may be necessary to offer flexible payment arrangements, such as installment plans or temporary payment reductions, to help the customer meet their obligations. Empathy and understanding can go a long way in maintaining positive customer relationships.

6.3. Lack of Communication

Customers may become unresponsive or avoid communication when they are unable to pay their debts, making it challenging to reach them and negotiate a resolution.

- Resolution: To overcome this challenge, it is essential to use multiple communication channels, such as phone, email, and mail, and to persist in your efforts to reach the customer. Sending certified mail with return receipt requested can ensure that the customer receives your communication.

6.4. Legal Constraints

Debt recovery is subject to various legal constraints, such as the Fair Debt Collection Practices Act (FDCPA) and the statute of limitations for collecting debts, which can limit your ability to pursue overdue payments.

- Resolution: To ensure compliance with legal requirements, it is essential to understand the relevant laws and regulations and to seek legal advice when necessary. Working with a reputable debt collection agency can also help ensure that your debt recovery practices are compliant.

6.5. Inefficient Processes

Inefficient debt recovery processes, such as manual invoice tracking and lack of automated reminders, can delay the collection of overdue payments and increase the risk of bad debts.

- Resolution: To improve efficiency, it is essential to automate your debt recovery processes using invoice management software, CRM systems, and debt collection software. Implementing automated workflows and reminders can help streamline the process and reduce the time it takes to collect overdue payments.

7. Resources and Tools for Debt Recovery

Various resources and tools are available to help businesses manage debt recovery effectively. These resources can provide guidance, templates, and software solutions to streamline the debt recovery process.

7.1. Government Agencies

Government agencies such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) provide resources and guidelines on debt collection practices.

- FTC: The FTC offers information on the Fair Debt Collection Practices Act (FDCPA) and provides resources for consumers and businesses on debt collection.

- CFPB: The CFPB provides resources on debt collection, including guides, fact sheets, and enforcement actions.

7.2. Industry Associations

Industry associations such as the Association of Credit and Collection Professionals (ACA) and the Credit Research Foundation (CRF) offer training, certification, and resources for debt collection professionals.

- ACA: The ACA provides training, certification, and resources for debt collection professionals, including compliance tools and best practices.

- CRF: The CRF offers research, education, and networking opportunities for credit and collection professionals, including publications, conferences, and webinars.

7.3. Legal Resources

Legal resources such as LegalZoom and Nolo provide templates for legal documents such as demand letters and payment agreements.

- LegalZoom: LegalZoom offers templates for legal documents, including demand letters, payment agreements, and contracts.

- Nolo: Nolo provides legal information and resources for consumers and businesses, including articles on debt collection and the statute of limitations.

7.4. Financial Resources

Financial resources such as the Small Business Administration (SBA) and Dun & Bradstreet provide information and resources for managing business finances, including debt recovery.

- SBA: The SBA offers resources for small businesses, including guides on managing cash flow and debt recovery.

- Dun & Bradstreet: Dun & Bradstreet provides credit information and business intelligence services, including credit reports and debt collection services.

8. CARDIAGTECH.NET: Your Partner in Efficient Automotive Repair

At CARDIAGTECH.NET, we understand the challenges automotive repair shops face in managing their finances and recovering overdue payments. That’s why we offer a range of high-quality tools and equipment to help you streamline your operations and improve your bottom line.

8.1. High-Quality Tools and Equipment

Our selection of diagnostic tools, scan tools, and other automotive equipment can help you diagnose and repair vehicles quickly and efficiently, reducing the time it takes to complete jobs and get paid.

- Diagnostic Tools: Our diagnostic tools can help you quickly identify the source of vehicle problems, allowing you to provide accurate estimates and complete repairs efficiently.

- Scan Tools: Our scan tools can help you read and clear diagnostic trouble codes (DTCs), providing valuable information for troubleshooting vehicle issues.

- Automotive Equipment: Our range of automotive equipment includes everything from lifts and jacks to tire changers and wheel balancers, helping you equip your shop for a wide range of repair tasks.

Alt text: An automotive diagnostic tool being used to diagnose a vehicle.

8.2. Streamlined Operations

By investing in high-quality tools and equipment, you can streamline your operations and reduce the time it takes to complete jobs, allowing you to invoice customers more quickly and improve your cash flow.

- Efficiency: Our tools and equipment are designed to improve efficiency and reduce the time it takes to complete repairs, allowing you to serve more customers and generate more revenue.

- Accuracy: Our diagnostic tools and scan tools provide accurate information, reducing the risk of errors and rework.

- Reliability: Our tools and equipment are built to last, providing reliable performance and reducing the need for costly repairs and replacements.

8.3. Improved Bottom Line

By streamlining your operations and improving your cash flow, you can improve your bottom line and invest in the growth of your business.

- Revenue: Our tools and equipment can help you generate more revenue by allowing you to serve more customers and complete repairs more efficiently.

- Cost Savings: Our tools and equipment can help you save money by reducing the risk of errors and rework and by improving the efficiency of your operations.

- Profitability: By improving your revenue and reducing your costs, you can improve your profitability and invest in the future of your business.

9. Call to Action: Contact CARDIAGTECH.NET Today

Ready to take control of your finances and streamline your automotive repair operations? Contact CARDIAGTECH.NET today to learn more about our range of high-quality tools and equipment and how they can help you recover overdue payments and improve your bottom line.

- Address: 276 Reock St, City of Orange, NJ 07050, United States

- WhatsApp: +1 (641) 206-8880

- Website: CARDIAGTECH.NET

Our team of experts is ready to answer your questions and help you find the perfect tools and equipment for your business. Don’t wait – contact us today and start improving your financial health!

FAQ: Recovering Overdue Debts

1. What is a debt recovery policy?

A debt recovery policy is a set of procedures and guidelines a business follows to collect overdue payments from customers, ensuring consistent and fair treatment while protecting the business’s financial health.

2. Why is a debt recovery policy important?

It protects business finances, maintains healthy cash flow, preserves customer relationships, and ensures legal compliance by providing a structured approach to managing overdue payments.

3. What are the key components of an effective debt recovery policy?

Key components include clear communication, a structured escalation process, thorough documentation, and adherence to legal considerations.

4. What is the first step in recovering an overdue payment?

The first step is to send a friendly payment reminder via phone, email, or letter when a payment first becomes overdue, including invoice details and payment options.

5. What should be included in an overdue payment reminder?

An overdue payment reminder should include the invoice number, amount due, due date, and instructions on how to make a payment, with a more assertive tone than the initial reminder.

6. When should a final notice be sent?

A final notice should be sent if the customer still hasn’t paid after the second reminder, clearly stating that further action will be taken if payment is not received by a specified date.

7. What is a formal letter of demand?

A formal letter of demand is a legal document outlining the amount owed, the due date, and the consequences of non-payment, typically sent by a lawyer or debt collection agency.

8. What is a debt collecting agency?

A debt collecting agency is a company that specializes in collecting overdue debts, using their resources and expertise to pursue the debt more aggressively.

9. How can technology help in debt recovery?

Technology streamlines the debt recovery process with invoice management software, CRM systems, debt collection software, and online payment gateways, improving efficiency and effectiveness.

10. What proactive measures can prevent customer debt?

Proactive measures include outlining expectations to new customers, invoicing efficiently, paying commissions when money is received, training staff in policies and procedures, and implementing financial controls.