Do You Provide Detailed and Clear Invoices to Customers?

Are you looking for ways to improve your auto repair shop’s invoicing process? Detailed and clear invoices are the foundation of strong customer relationships and efficient cash flow, so CARDIAGTECH.NET helps you understand why they’re crucial. Keep reading to explore the essential components of a professional invoice, along with best practices that ensure prompt payments and customer satisfaction. Equip your auto repair shop with the tools for invoicing success, leading to improved financial health and a stellar reputation.

1. What is an Invoice?

An invoice is a formal document that a business sends to a customer, and it’s more than just a bill; it’s a cornerstone of financial transparency and legal compliance. According to Stripe, an invoice serves as a detailed record of goods or services provided, specifying the amount the customer owes. It’s a vital component of the sales and payment process, acting as a bill of sale, receipt, and legal verification of the transaction.

- Formal Request: Invoices clearly state the amount due for services rendered, prompting customers to make payments.

- Detailed Record: They offer a breakdown of the transaction, which improves financial management and transparency for both parties.

- Legal Document: Invoices can act as evidence of a transaction in case of disputes or audits.

2. What are Invoices Used For?

Invoices serve multiple crucial functions for businesses, well beyond simply requesting payment. They are essential for revenue tracking, financial management, record keeping, tax purposes, and even legal protection. Effective use of invoices can streamline operations and boost your bottom line.

Here’s a detailed breakdown:

| Function | Description |

|---|---|

| Payment Requests | Invoices serve as a formal request for payment, clearly outlining the amount due for the services or goods provided. This facilitates a smooth and transparent payment process. |

| Revenue Tracking | Invoices provide a chronological record of all business transactions, making it easier to monitor sales trends, identify seasonal patterns, and evaluate the performance of specific services. This data is crucial for strategic decision-making. |

| Financial Management | Accurate and timely invoicing is essential for maintaining healthy cash flow. By promptly issuing invoices and following up on outstanding payments, businesses can ensure they have sufficient liquidity to meet their financial obligations. |

| Record Keeping | Invoices act as official records of each sale, helping businesses track inventory, monitor customer purchasing habits, and manage account balances. This detailed record-keeping is vital for efficient business operations. |

| Tax Purposes | Invoices are a central part of tax filing, providing the necessary documentation to calculate revenue, claim tax deductions, and substantiate expenses. Proper invoicing practices ensure compliance with tax regulations. |

| Legal Protection | Invoices serve as legal documents that can be used in the event of disputes or audits. They provide a detailed account of transactions, which can be used to resolve payment disagreements or verify financial activity. |

| Customer Communication | Invoices can be used to communicate important information to customers, such as payment terms, contact details, and even promotional offers. This helps maintain clear communication and build strong customer relationships. |

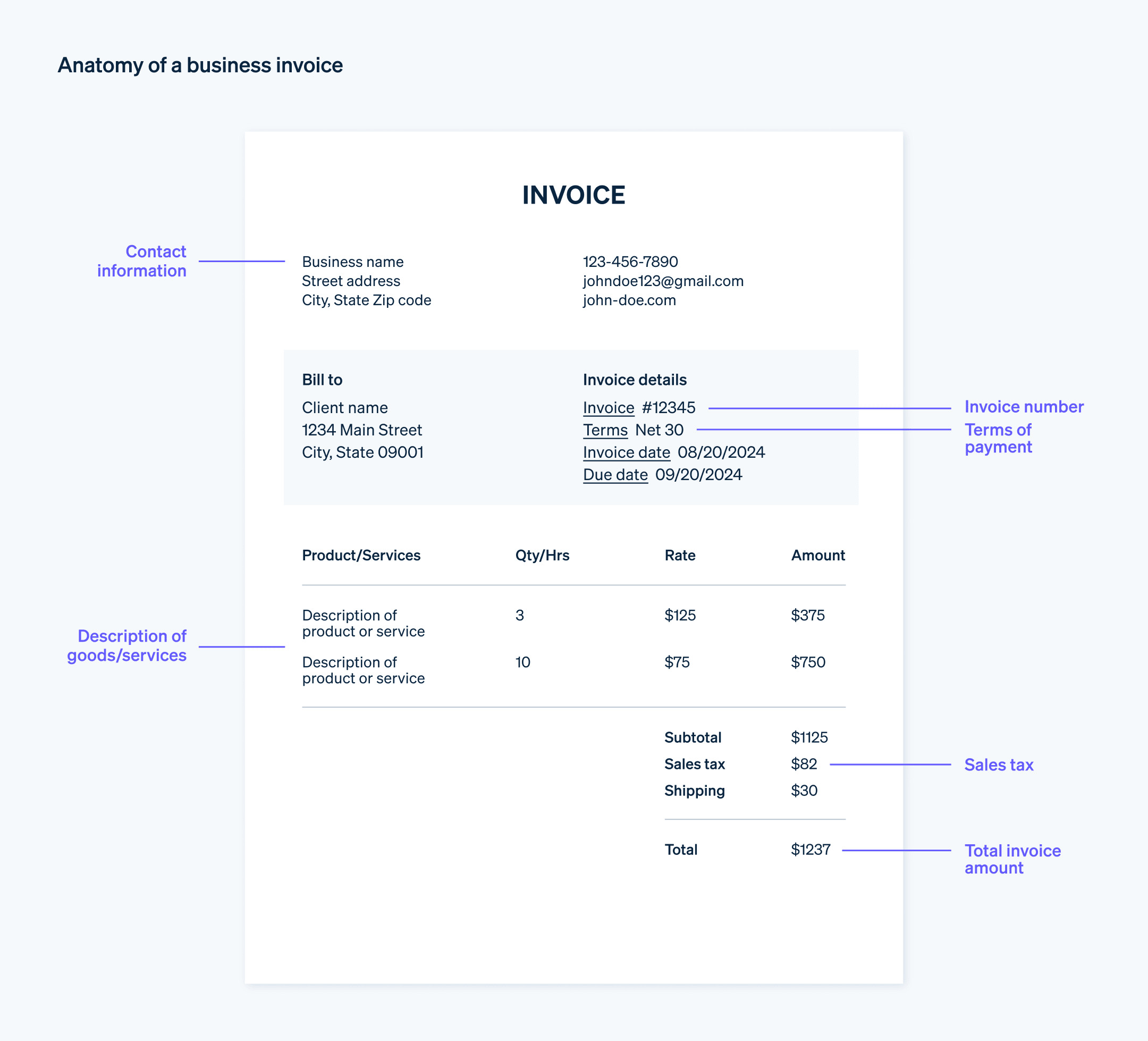

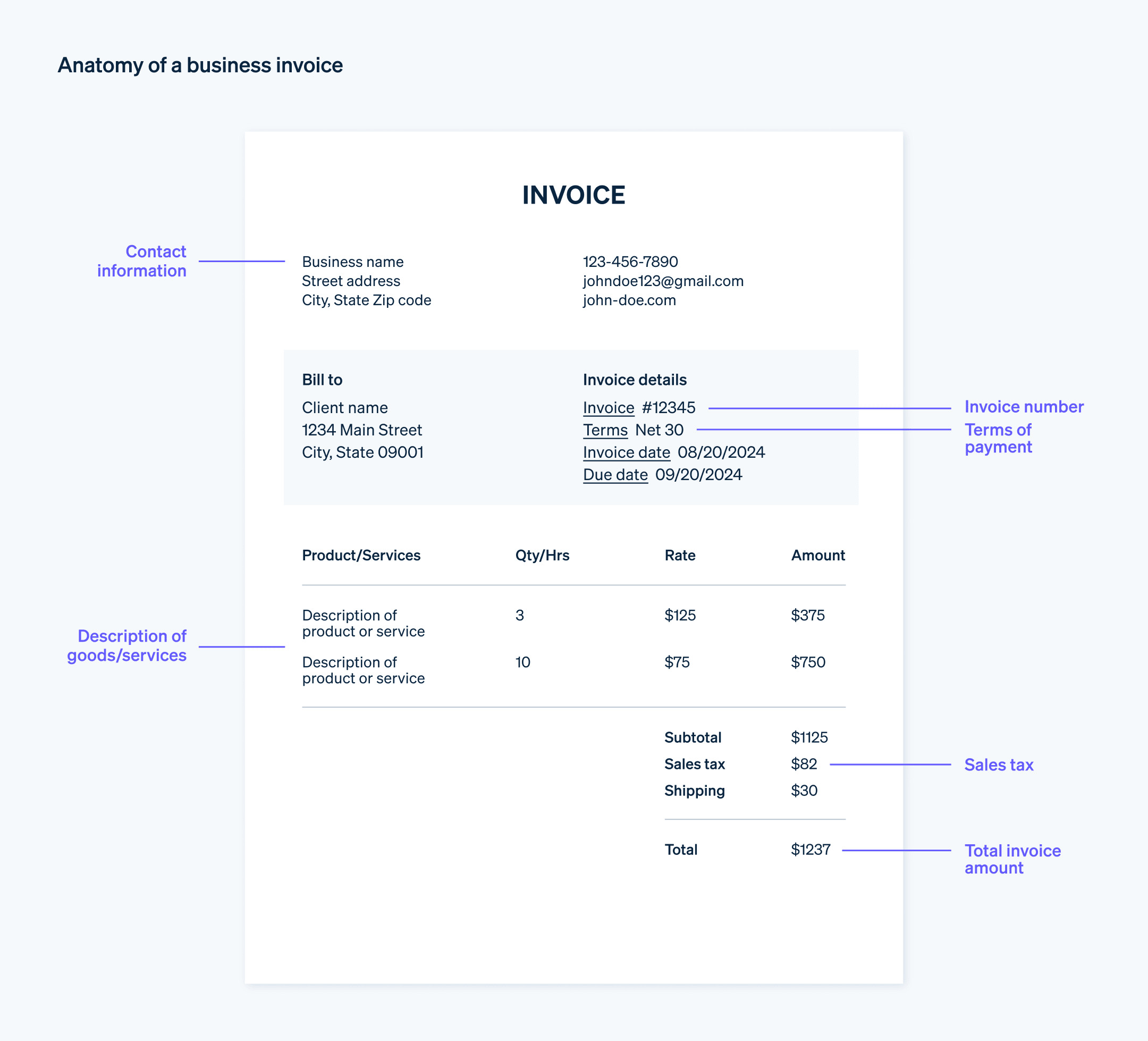

3. Invoice Requirements: What to Include on an Invoice

To create effective invoices that meet legal requirements and facilitate prompt payment, certain elements must be included. Ensuring each invoice contains these components will streamline your operations and minimize disputes.

Here’s a breakdown of the key components that CARDIAGTECH.NET recommends you include on every invoice:

- Header: The word “Invoice” should be prominently displayed at the top of the document.

- Your Business Information:

- Company Name

- Business Address: 276 Reock St, City of Orange, NJ 07050, United States

- Contact Details: Whatsapp: +1 (641) 206-8880

- Website: CARDIAGTECH.NET

- Company Logo (optional but recommended)

- Customer’s Business Information:

- Name

- Address

- Contact Details

- Invoice Number: A unique identification number for each invoice.

- Invoice Date: The date the invoice was issued.

- Payment Terms:

- Due Date: Specify when payment is expected (e.g., Net 30, Due on Receipt).

- Accepted Payment Methods: List the ways you accept payment (e.g., credit card, bank transfer, cash).

- Late Payment Penalties: If applicable, clearly state any penalties for late payments.

- Itemized List of Goods or Services:

- Description: A clear and concise description of each item or service provided.

- Quantity/Hours: The quantity of each item or the number of hours worked.

- Rate: The price per item or hourly rate.

- Total Amount: The total amount for each line item (quantity/hours x rate).

- Subtotal: The total amount due before taxes, fees, or discounts.

- Taxes, Fees, and Discounts:

- Sales Tax/VAT: If applicable, list the tax rate and amount.

- Shipping Fees: Any additional charges for shipping.

- Discounts: Clearly state any discounts applied.

- Total Amount Due: The final amount the customer owes, including taxes and fees, minus any discounts.

- Notes: This section can include additional information such as thank you notes, reminders, or special instructions.

Business invoice example with required elements highlighted

Business invoice example with required elements highlighted

4. Invoice Best Practices: How to Write an Invoice

Beyond the essential elements, there are several best practices to consider when creating invoices. These practices contribute to a professional image, reduce payment delays, and improve customer satisfaction.

CARDIAGTECH.NET recommends the following:

- Be Clear and Concise: Avoid ambiguity by providing simple, easy-to-understand descriptions for each charge.

- Use Professional Formatting: Consistent spacing, readable fonts, and a logical layout enhance the credibility of your business.

- Employ Unique Invoice Numbers: Use sequential numbers or incorporate dates/customer codes for easy tracking.

- Set Clear Payment Terms: Specify due dates and accepted payment methods to avoid confusion.

- Itemize Services or Products: Detail each service or product on a separate line to facilitate understanding and minimize disputes.

- Apply Taxes and Discounts Correctly: Calculate taxes, fees, and discounts accurately to ensure the total amount due is correct.

- Be Polite: Include a brief thank you note or message to foster better relationships.

- Send Promptly: Send invoices as soon as possible after providing goods or services to expedite payment.

- Follow Up: Send friendly reminders for overdue payments to encourage timely settlement.

- Keep Copies: Maintain copies of all invoices for financial management, tax purposes, and potential disputes.

5. Benefits of Upholding Strong Invoicing Practices

Strong invoicing practices are not just about getting paid; they’re about building a sustainable business with healthy cash flow and satisfied customers.

Here’s how effective invoicing can benefit your auto repair shop, according to CARDIAGTECH.NET:

- Improving Cash Flow Management: Prompt and clear invoices lead to faster payment turnaround, ensuring you have the necessary funds to cover operational costs and invest in your business.

- Increasing Customer Satisfaction: Transparent and accurate invoicing builds trust, leading to repeat business and positive referrals.

- Enhancing Your Professional Image: Well-crafted invoices reflect positively on your business, boosting customer confidence and setting a high standard for your transactions.

- Facilitating Timely Payments: Clear invoices reduce misunderstandings and queries, encouraging customers to prioritize settling their dues.

- Managing Your Financial Records: Detailed invoices simplify bookkeeping, making it easier to track income, reconcile accounts, and prepare financial statements.

6. The Impact of Technology on Modern Invoicing

Modern technology has revolutionized the invoicing process, offering businesses unprecedented efficiency and accuracy. Cloud-based invoicing software, automated payment reminders, and mobile invoicing solutions are just a few examples of how technology is transforming the way businesses manage their finances.

6.1. Cloud-Based Invoicing Software

Cloud-based invoicing software allows businesses to create, send, and manage invoices from anywhere with an internet connection. This eliminates the need for manual data entry and reduces the risk of errors. According to a study by Accenture, businesses that adopt cloud-based solutions experience a 20% reduction in operational costs and a 15% increase in efficiency.

Benefits of Cloud-Based Invoicing Software:

- Accessibility: Access your invoices from any device with an internet connection.

- Automation: Automate repetitive tasks such as invoice creation and payment reminders.

- Security: Cloud providers invest heavily in security measures to protect your data.

- Scalability: Easily scale your invoicing capabilities as your business grows.

6.2. Automated Payment Reminders

Automated payment reminders help businesses reduce the number of late payments by automatically sending reminders to customers before and after the due date. This saves time and effort compared to manually sending reminders and improves cash flow. A report by Dun & Bradstreet found that businesses that use automated payment reminders experience a 30% reduction in overdue invoices.

Advantages of Automated Payment Reminders:

- Reduced Late Payments: Automated reminders prompt customers to pay on time.

- Time Savings: Eliminate the need for manual follow-up on overdue invoices.

- Improved Cash Flow: Faster payments lead to improved cash flow and financial stability.

- Customization: Tailor reminders to match your brand and customer communication preferences.

6.3. Mobile Invoicing Solutions

Mobile invoicing solutions enable businesses to create and send invoices from their smartphones or tablets. This is particularly useful for businesses that provide on-site services, as it allows them to invoice customers immediately after completing a job. A survey by Intuit found that businesses that use mobile invoicing get paid twice as fast as those that don’t.

Benefits of Mobile Invoicing Solutions:

- Convenience: Invoice customers on the spot, from anywhere.

- Faster Payments: Get paid faster by sending invoices immediately after completing a job.

- Professionalism: Impress customers with professional-looking invoices created on the go.

- Real-Time Tracking: Track invoice status and payments in real-time.

7. Strategies for Minimizing Invoice Disputes

Invoice disputes can be a significant source of frustration and delay payments, but they can be minimized with proactive strategies. Clear communication, detailed documentation, and flexible payment options can help prevent disputes and maintain positive customer relationships.

7.1. Clear Communication

Clear communication is essential for preventing invoice disputes. Before starting a job, discuss the scope of work, pricing, and payment terms with the customer. Provide a detailed estimate or quote and get their approval before proceeding. During the project, keep the customer informed of any changes or additional costs.

Tips for Clear Communication:

- Provide Detailed Estimates: Outline the scope of work, pricing, and payment terms in writing.

- Obtain Customer Approval: Get the customer’s approval before starting the job or making any changes.

- Keep Customers Informed: Provide regular updates on the progress of the project and any changes to the original estimate.

- Be Responsive: Respond promptly to customer inquiries and address any concerns they may have.

7.2. Detailed Documentation

Detailed documentation is crucial for resolving invoice disputes. Keep accurate records of all work performed, including dates, hours, materials used, and any additional costs incurred. Provide a detailed invoice that clearly itemizes all charges and includes supporting documentation such as photographs or receipts.

Elements of Detailed Documentation:

- Accurate Records: Keep accurate records of all work performed, including dates, hours, and materials used.

- Itemized Charges: Provide a detailed breakdown of all charges on the invoice.

- Supporting Documentation: Include photographs, receipts, or other documentation to support your claims.

- Clear Descriptions: Use clear and concise descriptions to explain each charge.

7.3. Flexible Payment Options

Offering flexible payment options can make it easier for customers to pay their invoices and reduce the likelihood of disputes. Accept multiple forms of payment, such as credit cards, bank transfers, and online payment platforms. Consider offering payment plans or discounts for early payments.

Examples of Flexible Payment Options:

- Credit Cards: Accept major credit cards such as Visa, Mastercard, and American Express.

- Bank Transfers: Allow customers to pay directly from their bank accounts.

- Online Payment Platforms: Use popular online payment platforms such as PayPal or Stripe.

- Payment Plans: Offer payment plans for larger invoices.

- Early Payment Discounts: Provide discounts for customers who pay their invoices early.

8. Utilizing Data Analytics to Improve Invoicing Efficiency

Data analytics can provide valuable insights into your invoicing processes, helping you identify areas for improvement and optimize your cash flow. By tracking key performance indicators (KPIs) such as invoice processing time, payment cycle, and overdue invoices, you can gain a deeper understanding of your invoicing efficiency and identify bottlenecks or inefficiencies.

8.1. Key Performance Indicators (KPIs)

KPIs are metrics that help you measure the performance of your invoicing processes. By tracking KPIs such as invoice processing time, payment cycle, and overdue invoices, you can gain valuable insights into your invoicing efficiency and identify areas for improvement.

Examples of Invoicing KPIs:

| KPI | Description |

|---|---|

| Invoice Processing Time | The average time it takes to create and send an invoice. |

| Payment Cycle | The average time it takes for customers to pay their invoices. |

| Overdue Invoices | The percentage of invoices that are past their due date. |

| Invoice Dispute Rate | The percentage of invoices that are disputed by customers. |

| Customer Satisfaction | A measure of how satisfied customers are with your invoicing processes. |

8.2. Identifying Bottlenecks

Data analytics can help you identify bottlenecks in your invoicing processes. For example, if you notice that your invoice processing time is high, you may need to streamline your invoice creation process. If you notice that your payment cycle is long, you may need to send payment reminders more frequently or offer more flexible payment options.

Strategies for Identifying Bottlenecks:

- Analyze KPI Trends: Look for trends in your KPIs over time to identify potential bottlenecks.

- Conduct Process Mapping: Map out your invoicing processes to identify areas where delays or inefficiencies occur.

- Gather Customer Feedback: Ask customers for feedback on your invoicing processes to identify areas for improvement.

- Use Data Visualization Tools: Use data visualization tools to create charts and graphs that highlight potential bottlenecks.

8.3. Optimizing Cash Flow

By using data analytics to improve your invoicing efficiency, you can optimize your cash flow and reduce the risk of financial problems. For example, if you can reduce your payment cycle by 10 days, you can free up cash that can be used to invest in your business or pay down debt.

Methods for Optimizing Cash Flow:

- Reduce Invoice Processing Time: Streamline your invoice creation process to reduce the time it takes to create and send invoices.

- Shorten Payment Cycle: Send payment reminders more frequently and offer more flexible payment options to encourage faster payments.

- Reduce Overdue Invoices: Implement strategies to reduce the number of overdue invoices, such as sending payment reminders and offering payment plans.

- Improve Customer Satisfaction: Ensure customer satisfaction with your invoicing processes to avoid disputes and delays.

9. Legal and Regulatory Considerations for Invoicing

Invoicing is subject to various legal and regulatory requirements that businesses must comply with. These requirements vary depending on the jurisdiction and industry, but typically include rules related to invoice content, record-keeping, and tax compliance.

9.1. Invoice Content Requirements

Most jurisdictions have specific requirements for what information must be included on an invoice. These requirements typically include the business name and contact information, customer name and contact information, invoice date, invoice number, a detailed description of the goods or services provided, the amount due, and any applicable taxes or fees.

Common Invoice Content Requirements:

- Business Name and Contact Information: Your business name, address, phone number, and email address.

- Customer Name and Contact Information: The customer’s name, address, phone number, and email address.

- Invoice Date: The date the invoice was issued.

- Invoice Number: A unique identification number for the invoice.

- Description of Goods or Services: A detailed description of the goods or services provided.

- Amount Due: The total amount due, including any applicable taxes or fees.

- Tax Information: Any applicable tax identification numbers or tax rates.

9.2. Record-Keeping Requirements

Businesses are typically required to keep records of all invoices for a certain period of time, often several years. These records may be required for tax audits or other legal proceedings. It is important to store invoices securely and ensure that they are easily accessible when needed.

Best Practices for Record-Keeping:

- Store Invoices Electronically: Store invoices electronically in a secure, cloud-based system.

- Back Up Your Data: Regularly back up your data to prevent data loss.

- Organize Your Files: Organize your files logically to make it easy to find invoices when needed.

- Retain Invoices for the Required Period: Retain invoices for the period of time required by law.

9.3. Tax Compliance

Invoices are an important part of tax compliance. Businesses must accurately calculate and collect sales tax or VAT on their invoices and remit these taxes to the appropriate authorities. Failure to comply with tax regulations can result in penalties and fines.

Tips for Tax Compliance:

- Accurately Calculate Sales Tax or VAT: Ensure that you are accurately calculating sales tax or VAT on your invoices.

- Collect Taxes from Customers: Collect sales tax or VAT from customers at the time of sale.

- Remit Taxes to the Authorities: Remit taxes to the appropriate authorities on time.

- Keep Accurate Records: Keep accurate records of all sales tax or VAT collected and remitted.

10. How CARDIAGTECH.NET Can Help You Streamline Your Invoicing Process

At CARDIAGTECH.NET, we understand the challenges that auto repair shops face when it comes to invoicing. That’s why we offer a range of tools and equipment designed to help you streamline your invoicing process and improve your cash flow.

10.1. Diagnostic Tools

Our diagnostic tools help you quickly and accurately diagnose vehicle problems, allowing you to create detailed and accurate invoices. With our tools, you can:

- Identify the root cause of vehicle problems

- Generate detailed diagnostic reports

- Provide accurate estimates for repairs

10.2. Repair Equipment

Our repair equipment helps you efficiently complete repairs, reducing the time it takes to invoice customers. With our equipment, you can:

- Complete repairs quickly and efficiently

- Minimize downtime

- Improve customer satisfaction

10.3. Software Solutions

We also offer software solutions that can help you automate your invoicing process. Our software solutions can:

- Create professional-looking invoices

- Send invoices electronically

- Track invoice status and payments

- Generate reports

Ready to transform your auto repair shop’s invoicing process? Contact CARDIAGTECH.NET today!

- Address: 276 Reock St, City of Orange, NJ 07050, United States

- Whatsapp: +1 (641) 206-8880

- Website: CARDIAGTECH.NET

Don’t let unclear or incomplete invoices hold you back. Let CARDIAGTECH.NET provide you with the tools and expertise you need to create detailed, clear invoices that improve cash flow, enhance customer satisfaction, and boost your bottom line. Contact us today to learn more!