Do You Take Advantage of Favorable Payment Terms From Suppliers?

Do you take advantage of favorable payment terms from suppliers? Absolutely, capitalizing on advantageous payment terms from suppliers, like early payment discounts, can significantly boost your business’s financial health and fortify supplier relationships. By optimizing your accounts payable process, you can unlock substantial cost savings and streamline your cash flow. CARDIAGTECH.NET can help you with auto repair tools and equipment to improve cashflow and working capital.

1. Understanding Favorable Payment Terms

Favorable payment terms are agreements between buyers and suppliers that offer benefits, such as discounts for early payments or extended payment deadlines. These terms can significantly impact a company’s cash flow and profitability. According to a study by the University of Michigan’s Ross School of Business, companies that actively manage their payment terms with suppliers experience a 15-20% improvement in working capital efficiency.

Payment terms dictate the specifics of when and how invoices are to be paid. A common example is “Net 30,” which means the full invoice amount is due within 30 days from the invoice date. However, more favorable terms can include discounts for early payments.

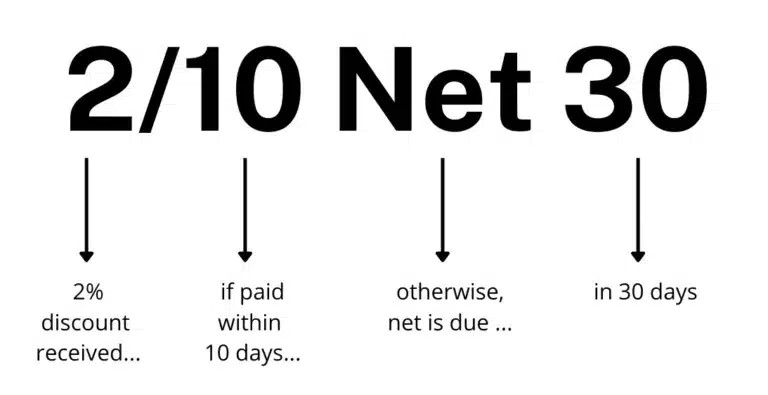

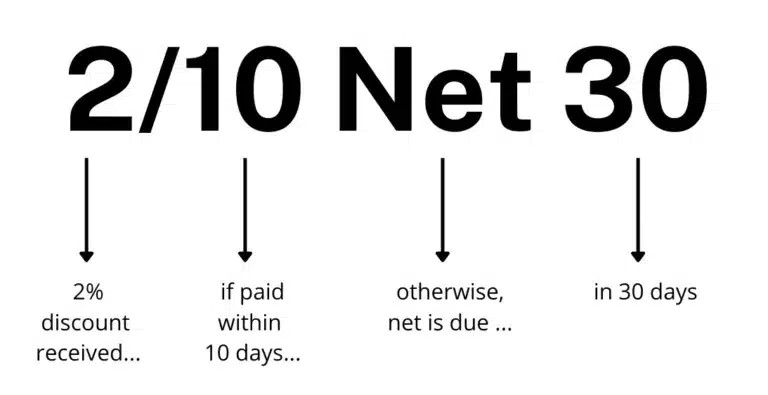

1.1. Decoding “2/10 Net 30”

The term “2/10 Net 30” is a trade credit term where a buyer receives a 2% discount on the net amount if the invoice is paid in full within ten days of the invoice date. Otherwise, the full invoice amount is due in 30 days without a discount. This is a common early payment discount offered by suppliers.

2/10 net 30 payment terms explained

2/10 net 30 payment terms explained

1.2. Calculating the Discount

Calculating the discount is straightforward. For example, if your business purchases $500 worth of goods or services on June 1st with terms of 2/10 net 30, you would calculate the discount as follows:

- Full Invoice Amount: $500

- Discount: 2%

- Discounted Amount: $500 * 0.02 = $10

- Payment Amount if Paid Within 10 Days: $500 – $10 = $490

So, if you pay between June 1st and June 10th, you only pay $490.

2. Methods for Accounting Early Payment Discounts

There are two primary methods for accounting for early payment discounts: the net method and the gross method. The choice between these methods depends on a company’s accounting policies and expectations regarding taking discounts.

2.1. Net Method

The net method records the invoice at the discounted amount, assuming the discount will be taken. This method is ideal if your company consistently takes advantage of early payment discounts.

Example:

Your company receives an invoice for $500 with terms of 2/10 net 30. Using the net method, you record the invoice at the discounted amount of $490.

- Initial Recording:

- Debit (Increase) Purchases/Inventory: $490

- Credit (Increase) Accounts Payable: $490

If the invoice is paid within ten days, no further adjustments are needed. However, if the discount is missed, an adjustment is required.

- Adjustment if Discount is Missed:

- Debit (Decrease) Accounts Payable: $490

- Credit (Decrease) Cash: $490

- Debit (Increase) Purchase Discounts Lost: $10

- Credit (Increase) Cash: $10

2.2. Gross Method

The gross method records the invoice at the full amount without subtracting the discount. This method is simpler and suitable for companies that do not consistently take early payment discounts.

Example:

Your company receives an invoice for $500 with terms of 2/10 net 30. Using the gross method, you record the invoice at the full amount of $500.

- Initial Recording:

- Debit (Increase) Purchases/Inventory: $500

- Credit (Increase) Accounts Payable: $500

If the invoice is paid within ten days and the discount is taken, an adjustment is needed.

- Adjustment if Discount is Taken:

- Debit (Decrease) Accounts Payable: $500

- Credit (Decrease) Cash: $490

- Credit (Increase) Purchase Discounts Taken: $10

3. Buyer-Initiated Early Payment Programs

Even if suppliers don’t offer early payment discounts, buyers can initiate programs to negotiate for them. These programs are managed through accounts payable and can take two forms: dynamic discounting and supply chain finance.

3.1. Dynamic Discounting

Dynamic discounting involves buyers offering early payment options on an invoice-by-invoice basis with varying discounts. According to a report by Aberdeen Group, companies using dynamic discounting achieve an average of 0.5-1.5% additional cost savings on their total spend.

Example:

A buyer offers a 2% discount to one supplier and a 1.3% discount to another, depending on their cash flow and strategic priorities.

3.2. Supply Chain Finance

Supply chain finance involves the buyer using a third-party financial institution to pay the supplier early. The buyer then repays the financial institution later. This method is particularly useful when a company has low cash balances but wants to take advantage of early payment discounts.

4. Alternative Early Payment Discount Terms

Besides 2/10 net 30, several alternative early payment terms can be used based on specific business needs and cash flow considerations.

4.1. Common Alternatives

| Term | Description |

|---|---|

| 1/10 Net 30 | 1% discount if paid within 10 days; full payment due in 30 days. |

| 3/10 Net 30 | 3% discount if paid within 10 days; full payment due in 30 days. |

| 2/10 Net 45 | 2% discount if paid within 10 days; full payment due in 45 days. |

| 3/20 Net 60 | 3% discount if paid within 20 days; full payment due in 60 days. |

These terms allow flexibility for both buyers and sellers to optimize their cash flow and financial strategies.

4.2. Tailoring Terms to Business Needs

For instance, a seller might offer 1/10 net 30 if they believe a 1% discount is sufficient to attract early payments, or 3/10 net 30 if they aim to maximize early cash collection.

5. Challenges in Implementing Early Payment Programs

Implementing early payment programs can be challenging, especially for businesses with manual accounts payable processes.

5.1. Common Challenges

- Lengthy Invoice Approval Processes: Delays in invoice approvals can prevent companies from meeting early payment deadlines.

- Lack of Data Visibility: Insufficient access to real-time financial data can hinder decision-making regarding early payments.

- Buyer-Seller Relationship Dynamics: Strong relationships are needed to negotiate favorable payment terms.

5.2. Overcoming Challenges with Automation

Automating accounts payable processes can overcome these challenges. End-to-end AP automation software with ERP integration streamlines invoice processing, global payments, and reconciliation. It provides real-time spend visibility for informed decisions. According to a study by PayStream Advisors, companies that automate their AP processes reduce invoice processing costs by as much as 80%.

The Supplier Hub enhances communication between suppliers and customers by providing automated invoice payment status, reducing the time AP staff spends on payment inquiries.

6. Advantages and Disadvantages

Utilizing 2/10 net 30 terms has benefits and drawbacks for both buyers and suppliers, which must be carefully considered.

6.1. For Buyers

- Advantages:

- Cost Savings: Taking advantage of early payment discounts reduces the overall cost of goods and services.

- Improved Supplier Relationships: Paying early can strengthen relationships with suppliers, leading to better terms and service.

- Disadvantages:

- Cash Flow Constraints: Early payments can strain cash flow if not managed properly.

6.2. For Suppliers

- Advantages:

- Accelerated Cash Flow: Receiving payments early improves cash flow, allowing for reinvestment in the business.

- Reduced Accounts Receivable Periods: Early payments reduce the time accounts receivable are outstanding.

- Disadvantages:

- Reduced Profit Margins: Offering discounts reduces profit margins on each sale.

7. Making the Decision: Is It Worth It?

A company should take advantage of 2/10 net 30 early payment discounts if they have sufficient cash flow or access to financing at a rate lower than the annualized interest rate of the discount.

7.1. Calculating Annualized Interest Rate

The annualized interest rate of 2/10 net 30 is approximately 36.7%. This is calculated as follows:

- Discount Rate: 2%

- Days Saved: 20 days (30 days – 10 days)

- Number of Periods in a Year: 360 / 20 = 18

- Annualized Interest Rate: (2% / (100% – 2%)) 18 = 0.0204 18 = 36.7%

Comparing this rate to a bank’s annual interest rate for financing helps determine if taking the discount is financially beneficial.

7.2. Comparing to Other Investment Opportunities

Another consideration is comparing the 2/10 net 30 annualized interest rate to the company’s Weighted Average Cost of Capital (WACC) or anticipated project returns. If other projects offer higher rates of return, investing in those projects may be more beneficial.

8. Practical Implementation

Effectively using early payment discounts requires a strategic approach and efficient processes.

8.1. Steps to Maximize Benefits

- Assess Cash Flow: Ensure sufficient cash is available to take advantage of early payment discounts without negatively impacting operations.

- Negotiate with Suppliers: Establish favorable payment terms with suppliers, including early payment discounts.

- Automate AP Processes: Implement AP automation software to streamline invoice processing and ensure timely payments.

- Monitor and Analyze: Track early payment discounts taken and analyze the impact on cash flow and profitability.

8.2. Tools and Technologies

Various tools and technologies can assist in managing and optimizing early payment discounts.

| Tool/Technology | Description | Benefits |

|---|---|---|

| AP Automation Software | Automates invoice processing, payment scheduling, and reconciliation. | Reduces manual effort, ensures timely payments, improves accuracy, and provides real-time visibility. |

| ERP Systems | Integrates financial data and provides comprehensive reporting capabilities. | Enables better financial planning, forecasting, and decision-making related to early payment discounts. |

| Supplier Portals | Facilitates communication and collaboration with suppliers. | Streamlines invoice submission, payment tracking, and dispute resolution, fostering stronger supplier relationships. |

| Dynamic Discounting Platforms | Automates the process of offering and managing dynamic discounts. | Optimizes cash flow, reduces costs, and strengthens supplier relationships. |

8.3. Real-World Scenario

Consider a small auto repair shop in Los Angeles, California, that regularly purchases parts from multiple suppliers. By negotiating 2/10 net 30 terms with its key suppliers and using AP automation software, the shop can ensure timely payments and capture early payment discounts.

Scenario:

- Monthly Purchases: $10,000

- Early Payment Discount: 2%

- Savings per Month: $10,000 * 0.02 = $200

- Annual Savings: $200 * 12 = $2,400

By saving $2,400 annually, the shop can reinvest in new equipment or training for its technicians, improving its overall competitiveness.

9. CARDIAGTECH.NET: Your Partner in Efficiency

CARDIAGTECH.NET understands the challenges faced by auto repair shops in managing their finances and supplier relationships. That’s why we offer a range of high-quality diagnostic tools and equipment to help you improve efficiency, reduce costs, and maximize profitability.

9.1. How CARDIAGTECH.NET Can Help

- High-Quality Products: Our diagnostic tools and equipment are designed to help you quickly and accurately diagnose and repair vehicles, reducing downtime and improving customer satisfaction.

- Competitive Pricing: We offer competitive pricing and flexible payment options to help you manage your cash flow effectively.

- Expert Support: Our team of experts is available to provide technical support and guidance, helping you get the most out of your investment.

9.2. Special Offer

Contact us today at +1 (641) 206-8880 or visit our website at CARDIAGTECH.NET to learn more about our products and services. As a special offer, new customers who mention this article will receive a 5% discount on their first purchase.

10. FAQs about Favorable Payment Terms

10.1. What are favorable payment terms?

Favorable payment terms are agreements between buyers and suppliers that offer benefits such as discounts for early payments or extended payment deadlines, improving cash flow and profitability.

10.2. What does “2/10 net 30” mean?

“2/10 net 30” means a buyer gets a 2% discount if they pay the invoice within 10 days; otherwise, the full amount is due in 30 days.

10.3. How do I calculate the discount with “2/10 net 30”?

To calculate the discount, multiply the invoice amount by 2%. For example, on a $500 invoice, the discount is $10, making the payment $490 if paid within 10 days.

10.4. What is the net method of accounting for discounts?

The net method records the invoice at the discounted amount, assuming the discount will be taken.

10.5. What is the gross method of accounting for discounts?

The gross method records the invoice at the full amount without subtracting the discount.

10.6. What is dynamic discounting?

Dynamic discounting is when buyers offer early payment options on an invoice-by-invoice basis with varying discounts.

10.7. What is supply chain finance?

Supply chain finance involves the buyer using a third-party to pay the supplier early, then repaying the third-party later.

10.8. What are some alternative early payment terms?

Alternative early payment terms include 1/10 Net 30, 3/10 Net 30, 2/10 Net 45, and 3/20 Net 60.

10.9. What challenges do companies face in implementing early payment programs?

Challenges include lengthy invoice approval processes, lack of data visibility, and buyer-seller relationship dynamics.

10.10. How can AP automation help with early payment discounts?

AP automation streamlines invoice processing, ensures timely payments, and provides real-time spend visibility, making it easier to take advantage of early payment discounts.

10.11. What are the advantages and disadvantages for buyers taking early payment discounts?

Advantages include cost savings and improved supplier relationships; disadvantages may include cash flow constraints.

10.12. What are the advantages and disadvantages for suppliers offering early payment discounts?

Advantages include accelerated cash flow and reduced accounts receivable periods; disadvantages include reduced profit margins.

10.13. How do I decide if my company should take advantage of 2/10 net 30?

Evaluate if you have enough cash or access to financing at a lower rate than the annualized interest rate of the discount (approximately 36.7%).

10.14. What is the annualized interest rate of 2/10 net 30?

The annualized interest rate of 2/10 net 30 is approximately 36.7%.

10.15. Where can I find high-quality diagnostic tools and equipment to improve efficiency in my auto repair shop?

You can find high-quality diagnostic tools and equipment at CARDIAGTECH.NET, located at 276 Reock St, City of Orange, NJ 07050, United States. Contact them at +1 (641) 206-8880.

11. Final Thoughts

Taking advantage of favorable payment terms from suppliers is a strategic move that can significantly benefit your business. By understanding the terms, implementing efficient processes, and leveraging technology, you can unlock substantial cost savings, improve cash flow, and strengthen supplier relationships. Remember to assess your cash flow, negotiate with suppliers, and automate your AP processes to maximize the benefits. Contact CARDIAGTECH.NET today to explore how our tools and equipment can help you achieve greater efficiency and profitability in your auto repair shop. Our address is 276 Reock St, City of Orange, NJ 07050, United States. Call us at +1 (641) 206-8880 or visit CARDIAGTECH.NET.